Moderators: Elvis, DrVolin, Jeff

JackRiddler wrote:Hey, I'm not married to Nomi Prins. (Lately I'm married to Yves Smith!) I've posted some stuff of Prins's I thought was good upthread (just go back, I don't know, 15-40 pages, ha), but I don't even remember what it was. I was just pointing out a couple of things in what you said. Such as that negative interest rates are possible. What would be the consequences? Fuck if I know, but it's possible. That last bit you quote is kind of shocking, however.

You should post those charts on the deficit you had...

http://www.counterpunch.org/2012/11/09/ ... them/print

This copy is for your personal, non-commercial use only.

Weekend Edition November 9-11, 2012

The Meaning of Obama's Win

By Their Fruits Ye Shall Know Them

by MICHAEL HUDSON

The Democrats could not have won so handily without the Citizens United ruling. That is what enabled the Koch Brothers to spend their billions to support right-wing candidates that barked and growled like sheep dogs to give voters little civilized option but to vote for “the lesser evil.” This will be President Obama’s epitaph for future historians. Orchestrating the election like a World Wrestling Federation melodrama, the Tea Party’s sponsors threw billions of dollars into the campaign to cast the President’s party in the role of “good cop” against stereotyped opponents attacking women’s rights, Hispanics and nearly every other hyphenated-American interest group.

In Connecticut, Senate candidate Linda McMahon spent a reported $97 million (including her earlier ego trip) to make her Democratic challenger look good. It was that way throughout the country. Republicans are pretending to wring their hands at their defeat, leaving the Democrats to beat up their constituency and take the blame four years from now.

Obama’s two presidential victories represent an object lesson about how the 1% managed to avoid rescuing the economy – and especially his own constituency – from today’s rush of wealth to the top. Future political annalists will see this delivery of his voters to his Wall Street campaign contributors control as his historical role. In the face of overwhelming voter opposition to the Bush-Cheney policies, the President has averted popular demands to save the economy from the 1%. Instead of sponsoring the hope and change he promised by confronting Wall Street, the pharmaceutical and health care monopolies, the military-industrial complex and big oil and gas, he has appeased them as if There is No Alternative.

If the Republican accusations are correct in accusing President Obama of steering America along the “European” course, it is not really socialism. It is neoliberal financial austerity, Greek style. His task over the next two months is to avoid using deficit spending to revive the economy.

The neoliberals whom he appointed as a majority on the Simpson-Bowles Commission already have inflated their trial balloon claiming that the government must balance the budget by slashing Social Security, Medicare and Medicaid, not by restoring progressive taxation. My UMKC colleague Bill Black calls this the Great Betrayal. “Only a Democrat can make it politically safe for Republicans who hate the safety net to unravel it” he notes.[1]

Having appointed the Bowles-Simpson commission members who seek to shift the tax burden off business onto consumers, the President will pave the way for Bush-type privatization. In his first debate with Mitt Romney, Mr. Obama assured his audience that they were in agreement on the need to balance the budget (his euphemism for scaling back Social Security, Medicare and Medicaid). By christening this “the Great Bargain,” President Obama has refined Orwellian doublethink. It is as if George Orwell went to work on Madison Avenue.

Four years ago the economy stood at a potential turning point in the war of finance against labor and industry, President Obama could have mobilizee public support for politicians willing to rescue hopes for prosperity. He could have appointed a Treasury Secretary and Federal Reserve chairman who would have used the government’s majority control of Citibank, Bank of America and other “troubled asset” holders to take these into the government sector to provide a public option. He could have written down debts to payable levels at only a fraction of the cost that was spent on rescuing Wall Street. Obama’s political genius was to avoid doing this and nonetheless keep his “street cred” as paladin defending the 99% rather than the 1%.

Having been elected with an enormous voter mandate, Mr. Obama could have reversed the sharp polarization between creditors who were pushing the 99%, industry and real

estate, cities and states deeper into financial distress. Instead, his policies have enabled the 1% to monopolize 93% of America’s income gains since the 2008 financial crisis.

At a potential turning point in the direction the American economy was taking, rescue and change were averted. We have seen what will stand as a classic example of cynical Orwellian doublethink. Promising hope and change four years ago, President Obama’s role was to hold back the tide and divert voter pressure for change. He rescued the financial sector and the 1%, and sponsored the Republican privatization of health care instead of the public option, and to take $13 trillion onto the government balance sheet in the form of junk mortgages, largely fraudulent loans held by Fannie Mae and Freddie Mac ($5.2 trillion alone) and other casino capitalist gambles gone bad. Mr. Obama was Wall Street’s white knight.

The trick was to get re-elected as a Democrat rather than as a Republican sponsoring a health care plan crafted by the Koch Brothers’ Cato Institute, and putting Wall Street bank lobbyists in charge of the Treasury and (de)regulatory agencies. As a Blue Dog Democrat, how was President Obama made to look better than the alternative?

The answer is clear by looking at the alternatives being offered. The Republicans have played ball. They call him a socialist – not too far fetched when we look at how Europe’s Socialist, Social Democrat and Labour parties are backing austerity and supporting anti-labor policies, privatization sell-offs and other neo-oligarchic policies. That is what socialism seems to mean these days.

While corporate profits are recovering nicely, most peoples’ savings and the net worth of their homes is down. This is not economically sustainable. Something has to give – and voters are afraid that it will be they their wages and savings. As corporate pensions plans are being cut back or reduced in bankruptcy, their under-funding suggests that debts to retirees will not be honored – only those to Wall Street. Big fish eat little fish, and the 1% are devouring the 99%. Those who describe how this is happening are accused of class war.

It is not the old fashioned class war of industry against employees. It is a war of finance against the entire economy. And as Warren Buffett has noted, the financial class is winning. Instead of breaking up the banks, the five largest “Too Big to Fail” banks have grown even larger. With support from the White House, they used their TARP bailout money to buy smaller banks, turning the financial sector into a vast monopoly that is busy privatizing the election process so as to hold the government hostage.

What is collapsing is the idea of equity and fairness in the economy – and in the politicians that are remaking markets to benefit the 1%. Most voters opposed the bank bailouts of 2008. The Republicans were politically savvy enough not to vote for it, so that they could strike a populist stance. But Mr. Romney has not picked up this line of attack, even though it might have enabled him to defeat a president in whom much of whose constituency has lost confidence.

There is disillusionment and many young people, minorities and the “Democratic wing of the Democratic Party” have been busy writing op-eds and blogs that this time they were going to “vote with their backsides” – by staying home. And that is pretty much what the election returns showed. Their complaint is that President Obama has broken nearly every campaign promise he made to voters – but not a single promise he made to his big campaign contributors!

That is the essence of being a politician today: to deliver one’s constituency of voters to the campaign contributors. In this respect Barack Obama is America’s version of Tony Blair; or alternatively, Margaret Thatcher and Neville Chamberlain rolled into one. We need a new word to describe this – something more than simply “irony.”

It’s not just Mr. Obama, of course. It’s the Democratic Party leadership. So here’s the litmus test to watch: On what committee and at what rank will the Senate put Elizabeth Warren?

Will she be named head of the Senate Banking Committee? Will she even be on it? Is she an embarrassment to Democratic fund-raisers on Wall Street – or window dressing to help give the impression that the Party really is other than crypto-Republican.

What inspired the Occupy Wall Street movement a year ago was a spontaneous protest against not only President Obama but also the Democratic Party for its lack of real effort to stem the right-wing tide. The Democrats did not rush to the OWS defense, although some operatives tried to jump in front of the parade and steer it into the usual liberal blind alley. (They did not succeed!) Voters have expressed a wish for just the opposite policy than the Democrats’ rightward turn, but the American political system excludes third parties, not being based on proportional representation as in Europe.

“By their fruits ye shall know them.” The Democrats took labor unions, minorities and middle class voters for granted because they had nowhere else to go, thanks to Mitt Romney giving Mr. Obama wide room to move to the right wing of the political spectrum. This is the political wrestling match that is being scripted.

We can see the denouement. As in Britain, unionized public-sector labor is being singled out. Chicago Mayor Rahm Emanuel, former White House Chief of Staff, showed his colors (and incensed Progressive Democrats) last week by signing a contract with contractor of about 350 airport maintenance workers to cut back their wages by up to $5 an hour (from $15 to $10).

How will the “Not Blue Dog” Democrats respond? Will Elizabeth Warren, Bernie Sanders, Sherrod Brown, Tammy Baldwin and Alan Grayson in the Senate and House take on the President in opposing austerity and the appointment of yet more Wall Street lobbyists to his cabinet?

Here’s the dilemma the American president faces: Markets are shrinking, and consumers are having to repay debts they earlier took on during the heady Bubble Economy that crashed in 2008. Paying down these debts leaves less to spend on goods and services. Labor productivity is soaring – but not wages. While the bailout economy’s fruits are going to profits and paid out as interest and dividends, neoliberals are demanding that the retirement age be raised, not lowered, and that work hours be lengthened more, not shortened. Federal Reserve Chairman Ben Bernanke’s helicopter only hovers over Wall Street, not the rest of the economy.

The middle class that voted so strongly for Mr. Obama four years ago is being squeezed. To describe their plight, I expect the next four years to see the spread of a fresh vocabulary to describe what is happening: debt deflation and neofeudalism, while the classic terms rentier and oligarchy may become popular once again.

But neither party will use these words. Only a third party can do that. Right now its potential members are called “Independents.” A new title is needed for a new pro-labor, anti-militarist coalition that would restore the spirit o0f true reform, progressive taxation and the rule of law (that is, throw financial crooks in jail). The problem the economy faces is how to revive wages and consumer demand, and to write down personal debts, not government debt. Mr. Obama has joined with the Republicans in perverting the vocabulary to pretend that government is the problem, not his campaign contributors on Wall Street.

Michael Hudson’s new book summarizing his economic theories, “The Bubble and Beyond,” is available on Amazon. He is a contributor to Hopeless: Barack Obama and the Politics of Illusion, published by AK Press. He can be reached via his website, mh@michael-hudson.com

Notes

[1] *http://neweconomicperspectives.org/2012/11/wall-street-urges-obama-to-commit-the-great-betrayal.html#more-3643

HP alleges Autonomy wrongdoing, takes $8.8 billion charge

By Poornima Gupta and Nicola Leske

Tue Nov 20, 2012 4:17pm EST

(Reuters) - Hewlett-Packard stunned Wall Street by alleging a massive accounting scandal at its British software unit Autonomy that will cost the company the majority of $8.8 billion in charges.

It was the latest in a string of reversals that have renewed questions about the basic competence of the storied company's board and senior managers.

HP said on Tuesday it discovered "serious accounting improprieties" and "a willful effort by Autonomy to mislead shareholders," after a whistleblower came forward following the ouster of Autonomy's then-chief executive, Mike Lynch, in May.

The charge follows a nearly $11 billion writedown last quarter for the company's EDS services division.

The technology company has been roiled in the past few years by a revolving door of CEOs, overall management turnover and challenges in its core personal computer and printer businesses.

HP's stock slid to a 10-year low, dropping 12 percent to $11.71 in regular trading on Tuesday. Shares are down nearly 50 percent year to date.

Lynch "flatly rejected" HP's allegations and said he was "shocked" but confident he would be absolved of any wrongdoing.

He had not been notified by HP about the allegation before it was made public, nor had he been contacted by any authorities, Lynch said in an interview with Reuters.

HP took $8.8 billion in charges in the quarter, with $5 billion tied to the problems at Autonomy. The rest of the charge related to the "recent trading value of HP stock and headwinds against anticipated synergies and marketplace performance," HP said.

HP said it has referred the matter to the U.S. Securities and Exchange Commission's enforcement division and the UK's Serious Fraud Office for civil and criminal investigation. It said it would take legal action to recoup "what we can for our shareholders."

Both agencies declined to comment.

HP Chief Executive Meg Whitman, who voted for the deal while she was on HP's board, said the investigation of Autonomy's finances - both external and internal - will take multiple years as it makes it way through the courts in both countries.

"Most of the board was here and voted for this deal, and we feel terribly about that," said Whitman on a call with analysts. "The board relied on audited financials, audited by Deloitte. Not Brand X accounting firm, but Deloitte," she said, adding that KPMG was hired to audit Deloitte.

"Neither of them saw what we now see after someone came forward to point us in the right direction," Whitman said.

INFLATED SALES, REVENUE

HP alleged that Autonomy's former management inflated revenue and gross margins to mislead potential buyers. It said Autonomy executives mischaracterized revenue from low-end hardware sales as software sales and booked some licensing deals with partners as revenue, even though no customer bought products.

HP said Autonomy claimed its gross margins were in the 40 percent to 45 percent range while realistically they were in the 28 percent to 30 percent range.

Moreover, Autonomy always represented itself as a software firm but 10 percent to 15 percent of its revenue came from money-losing sales of low-end hardware, HP said.

The company also claimed that Autonomy was booking licensing revenue upfront before deals closed.

HP has embarked on an internal investigation, including a forensic review by PricewaterhouseCoopers of Autonomy's historical financial results, under HP General Counsel John Schultz after the whistleblower came forward in May.

Schultz said since the accounting troubles occurred prior to the acquisition of Autonomy, it took a long time before HP was in a position to make the news public.

"Not surprisingly, Autonomy did not have sitting on a shelf somewhere a set of well-maintained books that would walk you through what was actually happening from a financial perspective inside the company," he said. "Indeed critical documents were missing from the obvious places, and it required that we look in every nook and cranny."

Whitman said her predecessor, Leo Apotheker and the former chief strategy officer, Shane Robison, were the key people behind the Autonomy acquisition.

Apotheker bought Autonomy to diversify HP's business and beef up its portfolio to provide one-stop shopping for corporations. The $11 billion acquisition of Autonomy - heavily criticized by investors as too costly - was a key part of the plan to transform HP.

Apotheker was ousted as CEO in September 2011 after just 11 months on the job and Robison left soon after.

In a statement, Apotheker said he was "stunned and disappointed" by the revelations and offered to make himself available to HP and the authorities to get to the bottom of the matter.

Whitman on Tuesday stood by Autonomy's technology and products despite the allegations, saying it will be the growth engine for HP. The former California gubernatorial candidate has been trying to move beyond some of HP's past controversies, which includes the ouster of the past two CEOs, a haphazard product strategy and a plan to sell its PC unit that was later dropped.

HP has been running Autonomy since the acquisition closed in October 2011, but it didn't find the accounting problems on its own. The company investigated only after a senior Autonomy executive came forward to detail the financial metrics surrounding Autonomy.

Advisers working on behalf of Autonomy included Qatalyst Partners, the investment bank run by technology investment banker Frank Quattrone; UBS; Goldman Sachs; Citigroup; JPMorgan Chase, and Bank of America. Perella Weinberg Partners and Barclays Capital advised for HP.

Law firms for Autonomy were Slaughter & May and Morgan Lewis. The firms for HP included Gibson, Dunn & Crutcher; Freshfields Bruckhaus Deringer; Drinker Biddle & Reath; and Skadden, Arps, Slate, Meagher & Flom.

Robert Enderle, a tech analyst at the Enderle Group, said he has never seen such a potential misrepresentation of financials.

"You have to rely on what the firm gives you during due diligence and I've never seen a misstatement at this level," Enderle said.

If the charges are true, it could result in a massive punitive damages award for HP, Enderle said.

Other analysts hoped it was the end of the bad news for HP.

"This kind of feels like the last of the bad news," Forrester analyst Frank Gillett said.

FOURTH-QUARTER LOSS

The Autonomy allegations and announcement of the charge coincided with the reporting of a fiscal fourth-quarter loss for HP.

HP said net revenue fell 6.7 percent to $29.96 billion for the quarter, ended October 31, from $32.12 billion a year earlier. Analysts, on average, expected $30.43 billion, according to Thomson Reuters I/B/E/S.

Revenue from all of its main business units declined, with the personal computer division recording the steepest drop, at 14 percent while revenue from printing fell 5 percent.

HP reported a quarterly net loss of $6.85 billion, or $3.49 a share, versus a profit of $239 million, or 12 cents, a year earlier.

The sprawling company, which employs more than 300,000 people globally, is undergoing a restructuring aimed at focusing on enterprise services in the mold of International Business Machines Corp.

"To put it bluntly ... this story has been an unmitigated train wreck, and it seems every time management speaks to the Street, there is new negative incremental information forthcoming," said ISI Group analyst Brian Marshall.

WHITE COLLAR CRIME

Insider Trading Scandal: Are the Feds Closing In on Billionaire Hedge Fund Mogul Steven Cohen?

By Sam GustinNov. 20, 2012Add a Comment

STEVE MARCUS / REUTERS

Hedge fund manager Steven A. Cohen, founder and chairman of SAC Capital Advisors, responds to a question during a one-on-one interview session at the SkyBridge Alternatives (SALT) Conference in Las Vegas, Nevada May 11, 2011.

Billionaire hedge fund titan Steven A. Cohen, one of the most high-profile and controversial Wall Street figures of the last decade, has been implicated in what federal officials are calling “the largest insider trading case ever charged by the SEC,” according to The Wall Street Journal.

Cohen, the founder of SAC Capital Advisors, wasn’t charged or mentioned by name in the federal criminal complaint unsealed Tuesday. But according to the Journal, which cited people familiar with the matter, Cohen is referred to as “Portfolio Manager A” in a parallel civil complaint filed by the Securities and Exchange Commission, also released Tuesday.

In the criminal complaint, federal prosecutors charged Mathew Martoma, a former portfolio manager at SAC Capital hedge fund affiliate CR Intrinsic Investors, with receiving and acting upon confidential information gleaned from a neurology professor who played a key role in a major pharmaceutical trial.

The SEC complaint alleges that “Portfolio Manager A” — who was not named — “collaborated closely with Martoma in making the trading decisions” at the center of the alleged $276 million insider-trading scheme. The plot allegedly involved a clinical trial for an Alzheimer’s disease drug called bapineuzumab that was being jointly developed by two pharmaceutical companies, Elan Corp. and Wyeth, which was bought by Pfizer in 2009. According to federal regulators, “the illicit gains generated in this scheme make it the largest insider trading case ever charged by the SEC.”

The complaints unsealed Tuesday are part of the federal government’s ongoing investigation into insider trading in the hedge fund industry — a probe that has already led to the convictions of former Galleon Group founder Raj Rajaratnam and former Goldman Sachs director and McKinsey managing director Rajat Gupta. Rajaratnan is currently serving an 11-year prison sentence, and last month Gupta was sentenced to two years in prison.

(MORE: Fallen Icon: Former Goldman Sachs Director Rajat Gupta Found Guilty)

“The charges unsealed today describe cheating coming and going – specifically, insider trading first on the long side, and then on the short side, on a scale that has no historical precedent,” Manhattan U.S. Attorney Preet Bharara said in a statement. “As a result of the blatant corruption of both the drug research and securities markets alleged, the hedge fund made profits and avoided losses of a staggering $276 million, and Martoma himself walked away with a $9 million bonus for his efforts.”

Martoma, 38, has been charged with one count of conspiracy to commit securities fraud and two counts of securities fraud; each fraud count carries up to 20 years in prison. Martoma was arrested and taken into custody by the FBI at his home in Boca Raton, Fla. at 6:30 a.m. Eastern time Tuesday, according to a FBI spokesperson cited by the Journal.

In the civil complaint, the SEC alleged that Martoma “illegally obtained confidential details” in the summer of 2008 from Dr. Sidney Gilman, a professor of neurology at the University of Michigan Medical School who served as chairman of the safety monitoring committee overseeing the drug trial. Martoma allegedly connected with Gillman, who is now age 80, through an unnamed “New York-based expert network firm.”

After Gilman allegedly provided Martoma with what the civil complaint describes a “material nonpublic information about the ongoing clinical trial,” Martoma “caused” several hedge funds to sell more than $960 million in Elan and Wyeth securities. After the alleged insider trading occurred, Martoma received a $9.3 million bonus.

“Today’s record-setting insider trading case reinforces the cold, hard lesson of so many other recent cases that when you trade on inside information, you’re not just betting your money but also your career, your reputation, your financial security, and your liberty,” Robert Khuzami, director of the SEC’s Division of Enforcement, said in a statement. “Now, yet another corrupt hedge fund manager has learned the high cost of ignoring that lesson.”

(More: TIME Cover Story: Preet Bharara — The Street Fighter)

It’s important to stress that Cohen, one of the most high-profile hedge fund billionaires on Wall Street, has not been charged or named in either the criminal or civil complaints. But according to the Journal, each document refers to him as the “Hedge Fund Owner” of two hedge-fund affiliates involved in the alleged scheme. Cohen has been investigated by law enforcement officials probing Wall Street insider trading for years, according to the Journal, but Tuesday’s unsealed complaints mark the closest they have gotten to associating Cohen with alleged wrongdoing.

“Steve Cohen is the ‘Teflon Don’ of Wall Street,” says Bill Singer, a partner at New York-based securities law firm Herskovitz. “The Feds and the SEC have cast a lot of innuendo, but they’ve never been able to get him in the noose.”

In a statement emailed to TIME, an SAC spokesman wrote: “Mr. Cohen and SAC are confident that they have acted appropriately and will continue to cooperate with the government’s inquiry.”

Charles Stillman, Martoma’s lawyer, issued the following statement cited by the Journal: “Mathew Martoma was an exceptional portfolio manager who succeeded through hard work and the dogged pursuit of information in the public domain. What happened today is only the beginning of a process that we are confident will lead to Mr. Martoma’s full exoneration.”

Gilman’s attorney told the Journal that his client is cooperating with federal prosecutors and the SEC. Gilman has entered into a “non-prosecution agreement” with the U.S. Attorney’s Office for the Southern District of New York, according to the criminal complaint, and has agreed to pay more than $234,000 in disgorgement and prejudgment interest, according to the SEC.

"Dr. Clive Boddy believes that increasingly fluid corporate career paths have helped psychopaths conceal their disruptive workplace behavior and ascend to previously unattainable levels of authority. Boddy points out psychopaths are primarily attracted to money, status and power, currently found in unparalleled abundance in the global banking sector. As if to prove the point, many of the world's money traders self identify as the "masters of the universe." Solution? Screening with psychological tests. Who would pay for it? The insurance industry."

http://www.huffingtonpost.com/2012/11/2 ... f=politics

CEO Council Demands Cuts To Poor, Elderly While Reaping Billions In Government Contracts, Tax Breaks

November 27, 2012

politics

Edition: U.S.

Christina Wilkie

christina.wilkie@huffingtonpost.com

Ryan Grim

ryan@huffingtonpost.com

Posted: 11/25/2012 10:11 am EST Updated: 11/26/2012 10:19 pm EST

WASHINGTON -- The corporate CEOs who have made a high-profile foray into deficit negotiations have themselves been substantially responsible for the size of the deficit they now want closed.

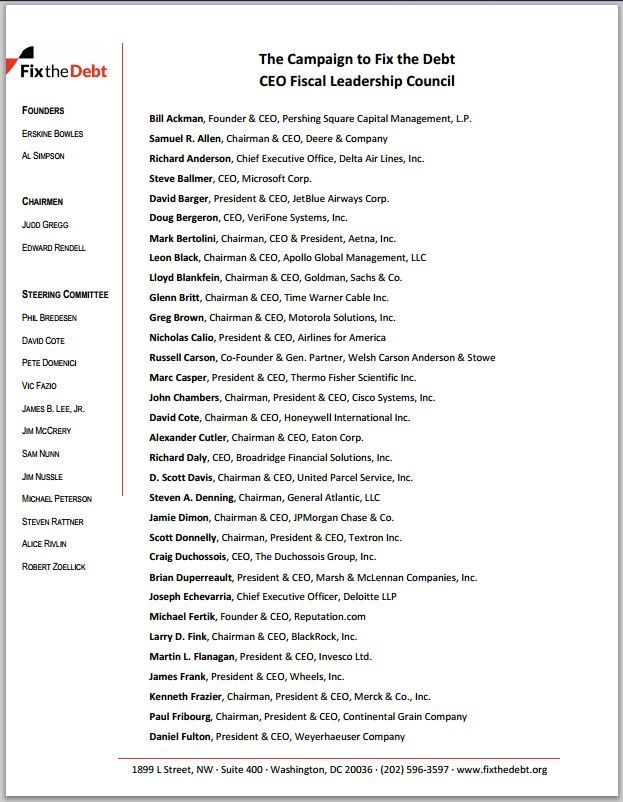

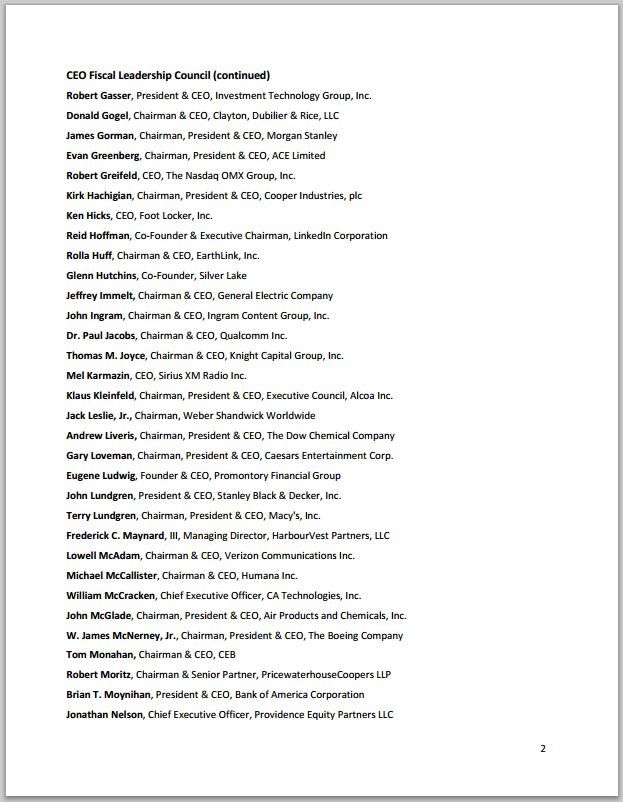

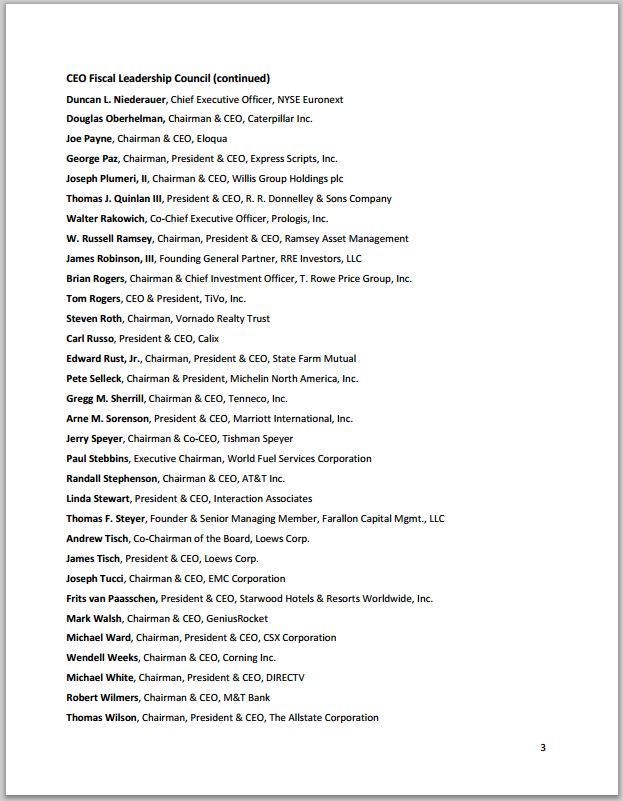

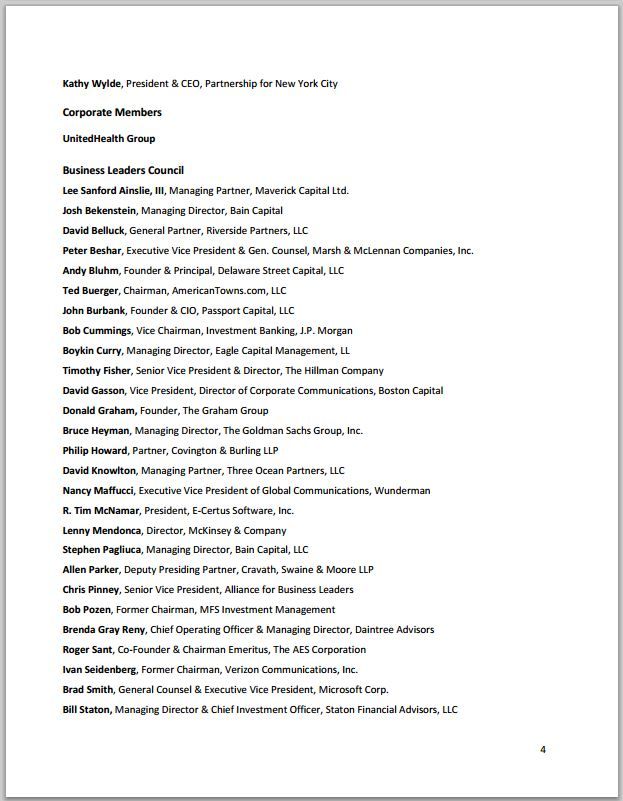

The companies represented by executives working with the Campaign To Fix The Debt have received trillions in federal war contracts, subsidies and bailouts, as well as specialized tax breaks and loopholes that virtually eliminate the companies' tax bills.

The CEOs are part of a campaign run by the Peter Peterson-backed Center for a Responsible Federal Budget, which plans to spend at least $30 million pushing for a deficit reduction deal in the lame-duck session and beyond.

During the past few days, CEOs belonging to what the campaign calls its CEO Fiscal Leadership Council -- most visibly, Goldman Sachs' Lloyd Blankfein and Honeywell's David Cote -- have barnstormed the media, making the case that the only way to cut the deficit is to severely scale back social safety-net programs -- Medicare, Medicaid, and Social Security -- which would disproportionately impact the poor and the elderly.

As part of their push, they are advocating a "territorial tax system" that would exempt their companies' foreign profits from taxation, netting them about $134 billion in tax savings, according to a new report from the Institute for Policy Studies titled "The CEO Campaign to ‘Fix’ the Debt: A Trojan Horse for Massive Corporate Tax Breaks" -- money that could help pay off the federal budget deficit.

Yet the CEOs are not offering to forgo federal money or pay a higher tax rate, on their personal income or corporate profits. Instead, council recommendations include cutting "entitlement" programs, as well as what they call "low-priority spending."

Many of the companies recommending austerity would be out of business without the heavy federal support they get, including Goldman Sachs and JPMorgan Chase, which both received billions in direct bailout cash, plus billions more indirectly through AIG and other companies taxpayers rescued.

Just three of the companies -- GE, Boeing and Honeywell -- were handed nearly $28 billion last year in federal contracts alone. A spokesman for Campaign To Fix The Debt did not respond to an email from The Huffington Post over the weekend.

The CEO council recommends two major avenues that it claims will produce "at least $4 trillion of deficit reduction." The first is to "replace mindless, abrupt deficit reduction with thoughtful changes that reform the tax code and cut low-priority spending." The second is to "keep debt under control over the long-term by focusing on the long-term growth of entitlement programs."

CEOs are encouraged to present a Fix-The-Debt PowerPoint presentation to their "employee town hall [meetings and] company meetings." To further help get the word out, the campaign borrowed a page from the CEOs this fall who wrote letters encouraging their employees to vote for Mitt Romney, or face job cuts. This time, the CFD has created two templates for bosses to use at their companies.

But in the past week, in order to make their case to the millions of Americans who don't work for them, CEOs fanned out into television, to convince the rest of the country that slashing the social safety net is the only way to reduce the deficit.

In an interview aired Monday, Goldman Sachs chairman and CEO Lloyd Blankfein said Social Security "wasn't devised to be a system that supported you for a 30 year retirement after a 25-year career." The key to cutting Social Security, he said, was simply a matter of teaching people to expect less.

"You're going to have to do something, undoubtedly, to lower people's expectations of what they're going to get," Blankfein told CBS, "the entitlements, and what people think they're going to get, because you're not going to get it."

Blankfein and Goldman Sachs don't have to worry about lowering expectations. After receiving a $10 billion federal bailout in 2008, and paying it back a few years later, Goldman Sachs recently exceeded Wall Street analysts' expectations by announcing $8.4 billion in third quarter revenues for 2012. On the heels of a great year, Blankfein is expected to take home an even larger salary than he did in 2011, when he made $16.1 million.

To understand the importance of banking profits to the members of the deficit council, one need look no further than the two top-ranking members of the Campaign To Fix The Debt's steering committee, former New Hampshire Sen. Judd Gregg (R) and former Pennsylvania Gov. Ed Rendell, a Democrat. Gregg is currently employed as an international adviser to Goldman Sachs, while Rendell collects his paycheck from the boutique investment bank Greenhill & Co.

Following Blankfein's evening news appearance on Monday, Cote, the Honeywell CEO, sat down with the same network on Tuesday, and said essentially the same thing that Blankfein did.

Cote ranked 11th on a list compiled in a recent study conducted by the Institute for Policy Studies of executives who have saved the most from the Bush tax cuts. According to the IPS, Cote's taxable compensation for 2011 was a bit more than $55 million, and he did not pay about $2.5 million thanks to the Bush tax cuts.

After mentioning a few scary-sounding deficit statistics, he suggested the government raise revenue by ending individual tax credits and deductions, which he said amounted to a $1 trillion "giveaway" in 2011. It was clear, however, that Cote hadn't come on the show to talk about taxes.

"The big nut is going to have to be [cuts to] Medicare/Medicaid … especially with the baby boomer generation retiring. It's going to literally crush the system."

But while Cote strongly recommends cutting those benefits, when it comes to the tax obligations of corporations, he's clear about what he wants: a corporate tax rate of zero.

"From a fairness perspective, nobody would be able to stand [a zero tax rate on corporate profits]," but if the U.S. really wanted to create jobs, he said this spring, "we would have the lowest rate possible."

At Honeywell, Cote practices what he preaches. Between 2008-2010, the company avoided paying any taxes at all. Instead, the company got taxpayer-funded rebates of $34 million off of profits totaling nearly $5 billion.

Part of what makes the lobbying blitz around the fiscal cliff so complex for CEOs on the Fiscal Leadership Council is that many of them need more than just low tax rates. They also need Congress and the White House to maintain current defense spending levels so they can continue winning enormous contracts.

In 2011, $40 billion of taxpayer money was divided among just nine CFD member companies, led by defense giant Boeing, which raked in $22 billion in federal contracts alone, more than the other eight companies combined. For his efforts as CEO, Boeing's Jim McNerney took home nearly $23 million in compensation last year.

But even as McNerney lends his name to the deficit commission, his company has quietly begun laying off U.S. workers ahead of defense cuts that are expected to be part of a deficit reduction deal. The company denies that federal spending has anything to do with the job cuts, but defense industry analysts aren't convinced.

At least one faction of Boeing's workforce is thriving: Boeing lobbyists in Washington have made $12 million since January fighting proposed cuts to defense and aerospace projects.

* Copyright © 2012 TheHuffingtonPost.com, Inc. |

WED NOV 28, 2012 AT 02:21 AM PST

Gigantic Journalistic Investigation Begins Ripping Mask Off Bank Secrecy

byKenneth Thomas

While Mitt Romney may be fading from view in the wake of his defeat on November 6, the issue of tax havens is definitely not following suit.

Via the Tax Justice Network, I've just learned of a massive, multi-national joint investigation into secrecy jurisdictions by three very heavy hitters, the Guardian, BBC Panorama, and the U.S.-based International Consortium of Investigative Journalists (ICIJ). Though they are starting out with the United Kingdom and the seriously understudied situation in the British Virgin Islands, ICIJ has announced that this is just the start of a multi-year investigative project and that there are "many more countries to come in the next 12 months." Further, according to ICIJ, the investigation involves literally "dozens of jurisdictions and in collaboration with dozens of media partners and freelance journalists around the world" (emphasis in original).

As I write this, the first and second articles (Nov. 25 and 26) in the Guardian's series rank number two and number one in the "most viewed" articles in the last 24 hours. One of the most amazing articles discusses the use of "nominee" directors, people who pretend to be a company or foundation's directors in order to hide the true ownership from authorities. Incredibly, these nominee directors frequently do not know the companies they are supposedly responsible for; they just know that they are getting paid for the use of their names. Be sure to check out the BBC undercover film linked from this Guardian article.

The tremendous scope of the journalistic investigation begs the question: where is government on this? Part of the answer is that government is way behind the curve. In 1999, the British government claimed to have stamped out a nominee sham colorfully named the "Sark Lark," for the tiny Channel Island of Sark where the nominees lived. However, it turns out that the perpetrators of the Sark Lark have simply moved all over the world to continue their scam; the BBC caught up with one former Sark resident in Mauritius.

The other part of the answer is that much of these activities are, in the immortal title of David Cay Johnston's book, "perfectly legal." It appears that in many cases governments do not make the effort to sift the illegal from the legal activities.

But let's not forget: tax havens cost the middle class worldwide hundreds of billions of dollars in tax revenue that they have to make up. The evidence is mounting that they are a central piece of the world financial system. Fundamental reform is necessary and a massive journalistic effort like this one will help produce the outrage to make it possible. I'm looking forward to more fruits of this investigation.

Bank of America CEO Brian Moynihan Apparently Can't Remember Anything

POSTED: November 27, 12:55 PM ET

Thank God for Bank of America CEO Brian Moynihan. If you're a court junkie, or have the misfortune (as some of us poor reporters do) of being forced professionally to spend a lot of time reading legal documents, the just-released Moynihan deposition in MBIA v. Bank of America, Countrywide, and a Buttload of Other Shameless Mortgage Fraudsters will go down as one of the great Nixonian-stonewalling efforts ever, and one of the more entertaining reads of the year.

In this long-awaited interrogation – Bank of America has been fighting to keep Moynihan from being deposed in this case for some time – Moynihan does a full Star Trek special, boldly going where no deponent has ever gone before, breaking out the "I don't recall" line more often and perhaps more ridiculously than was previously thought possible. Moynihan seems to remember his own name, and perhaps his current job title, but beyond that, he'll have to get back to you.

The MBIA v. Bank of America case is one of the bigger and weightier lawsuits hovering over the financial world. Prior to the crash, MBIA was, along with a company called Ambac, one of the two largest and most reputable names in what's called the "monoline" insurance business.

Bank of America: Too Crooked to Fail

The monolines sell a kind of investment insurance – if you invest in a municipal bond or in mortgage-backed securities backed or "wrapped" by a monoline, you have backing in case the investment goes south. If a municipality defaults on its bond payments, or homeowners in a mortgage-backed security default on their mortgage payments, the investors in those instruments can collect from the monoline insurer.

When companies like Countrywide issued their giant piles of crappy subprime mortgages and then chopped them up and turned them into AAA-rated securities to sell to suckers around the world, they often had these mortgage-backed securities insured by companies like MBIA or Ambac, to make their customers feel doubly safe about investing in their product.

The pitch firms like Countrywide made went like this: not only are these mortgages triple-A rated by reputable ratings agencies like Moody's, they're fully insured by similarly reputable insurance companies like MBIA. You can't lose!

With protection like that, why shouldn't your state pension fund or foreign trade union buy billions' worth of these mortgage-backed products? It's not like it would ever turn out that Countrywide made those products by trolling the cities of America stuffing mortgages in the pockets of anything with a pulse.

After 2007-8, when all of those mortgage-backed securities started blowing up, suddenly all of those insurance companies started having to pay out billions in claims. Ambac went bankrupt and MBIA was downgraded from AAA to near-junk status. The entire monoline industry was shattered.

The analogy one could make is that Countrywide sold a million flood-insured houses in New Orleans and Biloxi even though they could already see Katrina gathering in the Caribbean. Then, after the storm, the insurers decided to sue.

MBIA sued Bank of America (which acquired Countrywide in 2008), claiming that Countrywide lied to MBIA about its supposedly strict underwriting standards, when in fact the firm was cranking out mortgages hand over fist, without doing any real due diligence at all. (Whether the monolines should have known better, or its agents perhaps did know better and sold the mountains of insurance anyway, is another matter). In its suit, MBIA claimed that Countrywide turned itself into a veritable machine of mortgage approvals:

Countrywide Home Loans' senior management imposed intense pressure on underwriters to approve mortgage loans, in some instances requiring underwriters to process 60 to 70 mortgage loan applications in a single day and to justify any rejections…

As a result of all of this, MBIA got stuck insuring a Himalayan mountain range of dicey mortgages. When the securities those mortgages backed started to fail, MBIA ended up paying out $2.2 billion in claims, helping crack the hull of the formerly staid, solid, AAA-rated firm.

Suits like this have the whole financial world on edge. The possibility that the banks might still have to pay gigantic claims to companies like MBIA (among a wide range of other claimants) has left Wall Street in a state of uncertainty about the future of some of the better-known, Too-Big-To-Fail companies, whose already-strained balance sheets might eventually be rocked by massive litigation payouts.

In the case of Bank of America, MBIA has long wanted to depose Moynihan because it was precisely Moynihan who went public with comments about how B of A was going to make good on the errors made by its bad-seed acquisition, Countrywide. "At the end of the day, we'll pay for the things Countrywide did," was one such comment Moynihan made, in November of 2010.

As it turns out, Moynihan was deposed last May 2. But the deposition was only made public this week, when it was filed as an exhibit in a motion for summary judgment. In the deposition, attorney Peter Calamari of Quinn Emmanuel, representing MBIA, attempts to ask Moynihan a series of questions about what exactly Bank of America knew about Countrywide's operations at various points in time.

Early on, he asks Moynihan if he remembers the B of A audit committee discussing Countrywide. Moynihan says he "doesn't recall any specific discussion of it."

He's asked again: In the broadest conceivable sense, do you recall ever attending an audit committee meeting where the word Countrywide or any aspect of the Countrywide transaction was ever discussed? Moynihan: I don't recall.

Calamari counters: It's a multi-billion dollar acquisition, was it not?

Moynihan: Yes, it was. Well, isn't that the kind of thing you would talk about?

Moynihan: not necessarily . . .

This goes on and on for a while, with the Bank of America CEO continually insisting he doesn't remember ever talking about Countrywide at these meetings, that you'd have to "get the minutes." Incredulous, Calamari, a little sarcastically, finally asks Moynihan if he would say he has a good memory.

"I would – I could remember things, yes," Moynihan deadpans. "I have a good memory."

Calamari presses on, eventually asking him about the state of Countrywide when Moynihan became the CEO, leading to the following remarkable exchange, in which the CEO of one of the biggest companies in the world claims not to know anything about the most significant acquisition in the bank's history (emphasis mine):

Q: By January 1st, 2010, when you became the CEO of Bank Of America, CFC – and I'm using the initials CFC, Countrywide Financial Corporation – itself was no longer engaged in any revenue-producing activities; is that right?

Moynihan: I wouldn't be the best person to ask about that because I don't know.

There are no sound effects in the transcript, but you can almost hear an audible gasp at this response. Calamari presses Moynihan on his answer.

"Sir," he says, "you were CEO of Bank Of America in January, 2010, but you don't know what Countrywide Financial Corporation was doing at that time?"

In an impressive display of balls, Moynihan essentially replies that Bank of America is a big company, and it's unrealistic to ask the CEO to know about all of its parts, even the ones that are multi-billion-dollar suckholes about which the firm has been engaged in nearly constant litigation from the moment it acquired the company.

"We have several thousand legal entities," is how Moynihan puts it. "Exactly what subsidiary took place [sic] is not what you do as the CEO. That is [sic] other people's jobs to make sure."

The exasperated MBIA lawyer tries again: If it's true that Moynihan somehow managed to not know anything about the bank's most important and most problematic subsidiary when he became CEO, well, did he ever make an effort to correct that ignorance? "Do you ever come to learn what CFC was doing?" is how the question is posed.

"I'm not sure that I recall exactly what CFC was doing versus other parts," Moynihan sagely concludes.

The deposition rolls on like this for 223 agonizing pages. The entire time, the Bank of America CEO presents himself as a Being There-esque cipher who was placed in charge of a Too-Big-To-Fail global banking giant by some kind of historical accident beyond his control, and appears to know little to nothing at all about the business he is running.

In the end, Moynihan even doubles back on his "we'll pay for the things Countrywide did" quote. Asked if he said that to a Bloomberg reporter, Moynihan says he doesn't remember that either, though he guesses the reporter got it right.

Well, he's asked, assuming he did say it, does the quote accurately reflect Moynihan's opinion?

"It is what it is," Moynihan says philosophically.

There's nothing surprising about any of this – it's natural that a Bank of America executive would do everything he could to deny responsibility for Countrywide's messes. But that doesn't mean it's not funny. By about the thirtieth "I don't recall," I was laughing out loud.

It's also more than a little infuriating. In the pre-crash years, Countrywide was the biggest, loudest, most obvious fraud in a marketplace full of them, and the legion of complainants who've since sued (ranging from the U.S. government to Norway's Sovereign Wealth Fund to state pension funds in Iowa and Oregon, among others) have found it painstaking work trying to get Bank of America to do the right thing and pay back the money its subsidiary took in its various ripoffs. And with executives boasting such poor memories, this story is going to drag on and on even longer.

We have, to some extent, gone against the prevailing economic orthodoxies of the American, European, and IMF model in the last 30 years. This has even been recognized by the IMF leadership.

As you know, the IMF program finished last year, and we organized a celebratory conference in October, where we said goodbye to the IMF program, and it was attended by Paul Krugman, and other prominent economists, as well as some of the leading officials of the IMF. And it was very interesting to hear them acknowledge that the IMF had probably learned more from this experience with Iceland than Iceland had learned from the IMF. It has made the IMF reconsider some of their orthodox stances on what should be the proper economic and financial response to a crisis on this nature.

Thirdly, we have, in our economic measures, tried to protect the lowest income sectors, we have to try and protect some of the elementary social and health services, and done more of that nature than has traditionally been done in dealing with such a crisis.

As everybody knows now, we did not pump public money into the failed banks. We treated them like private companies that went bankrupt, and we let them fail. Some people say we did it because we didn’t have any other option, there is clearly something in that argument, but it does not change the fact that it turned out to be a wise move or whatever reason. Whereas in many other countries, the prevailing orthodoxy is you pump public money into banks and you make taxpayers responsible for the banks in the long run, and somehow treat the banks as if they are holier institutions in the economy than manufacturing companies, commercial companies, IT companies, or whatever. And I have never really understood the argument: why a private bank or financial fund is somehow holier for the well being and future of the economy than the industrial sector, the IT sector, the creative sector, or the manufacturing sector.

So if you add all of this together and throw in the devaluation of the currency as well, it’s clear that what some people have called the Icelandic model includes a number of measures and approaches that have not been adopted in other countries. On the contrary, it includes some methods in the process that go directly against what has been adopted in other countries. But the outcome is the Icelandic economy is recovering faster and more effectively than any other economy, including the British and the American that suffered from a big financial crisis in 2008.

http://www.positivemoney.org/where-does ... from-book/

Executive Summary

Watch the video or read the summary below

There is widespread misunderstanding of how new money is created. This book examines the workings of the UK monetary system and concludes that the most useful description is that new money is created by commercial banks when they extend or create credit, either through making loans or buying existing assets. In creating credit, banks simultaneously create deposits in our bank accounts, which, to all intents and purposes, is money.

Many people would be surprised to learn that even among bankers, economists, and policymakers, there is no common understanding of how new money is created. This is a problem for two main reasons. First, in the absence of this understanding, attempts at banking reform are more likely to fail. Second, the creation of new money and the allocation of purchasing power are a vital economic function and highly profitable.

This is therefore a matter of significant public interest and not an obscure technocratic debate. Greater clarity and transparency about this could improve both the democratic legitimacy of the banking system and our economic prospects.

Defining money is surprisingly difficult. We cut through the tangled historical and theoretical debate to identify that anything widely accepted as payment, particularly by the government as payment of tax, is, to all intents and purpose, money. This includes bank credit because although an IOU from a friend is not acceptable at the tax office or in the local shop, an IOU from a bank most definitely is.

We identify that the UK’s national currency exists in three main forms, the second two of which exist in electronic form:

1) Cash – banknotes and coins.

2) Central bank reserves – reserves held by commercial banks at the Bank of England.

3) Commercial bank money – bank deposits created either when commercial banks lend money, thereby crediting credit borrowers’ deposit accounts, make payments on behalf of customers using their overdraft facilities, or when they purchase assets from the private sector and make payments on their own account (such as salary or bonus payments).

Only the Bank of England or the government can create the first two forms of money, which is referred to in this book as ‘central bank money’. Since central bank reserves do not actually circulate in the economy, we can further narrow down the money supply that is actually circulating as consisting of cash and commercial bank money.

Physical cash accounts for less than 3 per cent of the total stock of money in the economy. Commercial bank money – credit and coexistent deposits – makes up the remaining 97 per cent of the money supply.

There are several conflicting ways of describing what banks do. The simplest version is that banks take in money from savers, and lend this money out to borrowers. This is not at all how the process works. Banks do not need to wait for a customer to deposit money before they can make a new loan to someone else. In fact, it is exactly the opposite; the making of a loan creates a new deposit in the customer’s account.

More sophisticated versions bring in the concept of ‘fractional reserve banking’. This description recognises that banks can lend out many times more than the amount of cash and reserves they hold at the Bank of England. This is a more accurate picture, but is still incomplete and misleading. It implies a strong link between the amount of money that banks create and the amount that they hold at the central bank. It is also commonly assumed by this approach that the central bank has significant control over the amount of reserves banks hold with it.

We find that the most accurate description is that banks create new money whenever they extend credit, buy existing assets or make payments on their own account, which mostly involves expanding their assets, and that their ability to do this is only very weakly linked to the amount of reserves they hold at the central bank. At the time of the financial crisis, for example, banks held just £1.25 in reserves for every £100 issued as credit. Banks operate within an electronic clearing system that nets out multilateral payments at the end of each day, requiring them to hold only a tiny proportion of central bank money to meet their payment requirements.

The power of commercial banks to create new money has many important implications for economic prosperity and financial stability. We highlight four that are relevant to the reforms of the banking system under discussion at the time of writing:

1) Although useful in other ways, capital adequacy requirements have not and do not constrain money creation, and therefore do not necessarily serve to restrict the expansion of banks’ balance sheets in aggregate. In other words, they are mainly ineffective in preventing credit booms and their associated asset price bubbles.

2) Credit is rationed by banks, and the primary determinant of how much they lend is not interest rates, but confidence that the loan will be repaid and confidence in the liquidity and solvency of other banks and the system as a whole.

3) Banks decide where to allocate credit in the economy. The incentives that they face often lead them to favour lending against collateral, or assets, rather than lending for investment in production. As a result, new money is often more likely to be channelled into property and financial speculation than to small businesses and manufacturing, with profound economic consequences for society.

4) Fiscal policy does not in itself result in an expansion of the money supply. Indeed, the government has in practice no direct involvement in the money creation and allocation process. This is little known, but has an important impact on the effectiveness of fiscal policy and the role of the government in the economy.

The basic analysis of this book is neither radical nor new. In fact, central banks around the world support the same description of where new money comes from. And yet many naturally resist the notion that private banks can really create money by simply making an entry in a ledger. Economist J. K. Galbraith suggested why this might be:

"The process by which banks create money is so simple that the mind is repelled. When something so important is involved, a deeper mystery seems only decent."

This book aims to firmly establish a common understanding that commercial banks create new money. There is no deeper mystery, and we must not allow our mind to be repelled. Only then can we properly address the much more significant question: Of all the possible alternative ways in which we could create new money and allocate purchasing power, is this really the best?

http://www.positivemoney.org/our-proposals/

MODERNISING MONEY

Why Our Monetary System is Broken & How it Can Be Fixed

As the title suggests, the book explains why the current monetary system is broken, and explains, in more detail than ever before, exactly how it can be fixed.” The product of three years of research and development, these proposals offer one of the few hopes of escaping from our current dysfunctional monetary system.

Modernising Money shows how a law first implemented in the UK in 1844 (but never updated) can be combined with reform proposals that grew out of the Great Depression of the 1930s to provide the UK with a stable monetary and banking system, low personal and government debt and a thriving economy. Whilst inspired by Irving Fisher’s original work and variants on it, the proposals outlined in this book have some significant differences. Detailed but accessible to non-economists. The book is likely to be released in January 2013.

Wall Street Professionals Admit: Yes, Lots of Us Are Corrupt

By Rich Smith, The Motley Fool

Posted 5:15PM 07/20/12 | AOL Original

Is Wall Street corrupt? Responses vary depending on whom you ask. But ask the folks who work in the financial services industry and you'll get a surprisingly clear answer: "Yes."

A recent survey of 500 financial services professionals, conducted by market researcher Populus at the behest of law firm Labaton Sucharow, turned up some surprisingly candid results from the folks surveyed. For example:But pressure need not be succumbed to. Surely these financial industry professionals put their ethics, and the interests of their clients, ahead of personal gain, right?

- 39% of financial industry insiders surveyed "reported that their competitors are likely to have engaged in illegal or unethical activity in order to be successful."

- And this was more than just suspicion. "26% of respondents indicated that they had observed or had firsthand knowledge of wrongdoing in the workplace."

- Nearly one in four "believed that financial services professionals may need to engage in unethical or illegal conduct in order to be successful.

- Nearly one in three said they themselves felt "pressured by bonus or compensation plans to violate the law or engage in unethical conduct.

Well ... not necessarily.Lies, Damn Liars, and Statistics

- 16% of respondents admitted that they -- personally -- would break the law by trading on insider information "if they could get away with it."

- Fewer than half could say unequivocally that they would not engage in insider trading in a situation where they knew for sure that they would get away with it.

- What's more, chances are they can get away with it. Because "only one in four financial services professionals believe [financial watchdogs such as the SEC or other government regulators] are effective."

Needless to say, these numbers are a bit discouraging. After all, these are the people to whom we entrust our money, our nest eggs, our life savings. The people who are supposed to use their expertise to help us establish a secure retirement. The folks who, in theory at least, have a fiduciary duty to obey the law and put the interests of their clients first.

Yet out of the ranks of these supposed paragons of virtue -- bankers, fund managers, asset managers, and analysts -- one in six lacks sufficient moral backbone to resist the temptation to break the law unless someone's constantly looking over their shoulders, making sure they play by the rules. (And that's the best-case scenario. Theoretically, as many as half of our financial "professionals" are potentially corruptible.)

Now add to this fact the apparently widespread conviction that "everybody else is doing it" -- and getting away with it -- and the further belief that breaking the law is almost a job requirement.

All of a sudden, the epidemic of mortgage fraud, the Bank of America (BAC)-Merrill Lynch bonus debacle, the Madoff scandal -- all of it starts to make sense. Suddenly, you start to understand why Goldman Sachs (GS) CFO David Viniar, when asked earlier this week whether decreased profitability at his firm was a cue to cut costs after he had just noted that Goldman was paying out 44% of all corporate revenue as compensation for his employees, responded simply that "we aren't going to cut our way to prosperity."

As I heard it, he might as well have responded: "Hey, I've got mine, Jack." Because on Wall Street today, that's apparently all that matters.

Motley Fool contributor Rich Smith holds no position in any company mentioned. The Motley Fool owns shares of Bank of America. Motley Fool newsletter services have recommended buying shares of Goldman Sachs.

http://www.democracynow.org/2012/12/13/ ... 00_million

Thursday, December 13, 2012 Full Show

Matt Taibbi: After Laundering $800 Million in Drug Money, How Did HSBC Executives Avoid Jail?

The banking giant HSBC has escaped indictment for laundering billions of dollars for Mexican drug cartels and groups linked to al-Qaeda. Despite evidence of wrongdoing, the U.S. Department of Justice has allowed the bank to avoid prosecution and pay a $1.9 billion fine. No top HSBC officials will face charges, either. We’re joined by Rolling Stone contributing editor Matt Taibbi, author of "Griftopia: A Story of Bankers, Politicians, and the Most Audacious Power Grab in American History." "You can do real time in jail in America for all kinds of ridiculous offenses," Taibbi says. "Here we have a bank that laundered $800 million of drug money, and they can’t find a way to put anybody in jail for that. That sends an incredible message, not just to the financial sector but to everybody. It’s an obvious, clear double standard, where one set of people gets to break the rules as much as they want and another set of people can’t break any rules at all without going to jail." [includes rush transcript]

Transcript

JUAN GONZÁLEZ: Well, let’s go on to HSBC. The banking giant has escaped indictment for laundering billions of dollars for Mexican drug cartels and groups linked to al-Qaeda. The bank reportedly supplied a billion dollars to a firm whose founder had ties to al-Qaeda and shipped billions in cash from Mexico to the United States despite warnings the money was coming from drug cartels. Earlier this year, a Senate investigation concluded that HSBC provided a, quote, "gateway for terrorists to gain access to U.S. dollars and the U.S. financial system."

Despite evidence of wrongdoing, the Justice Department has allowed the bank to avoid prosecution and pay a $1.9 billion fine. No top HSBC officials will face charges. While it’s reportedly the largest penalty ever paid by a bank, the deal has come under wide criticism. Officials reportedly agreed to seek the fine over concerns that criminal charges would have hurt the global financial system.

Loretta Lynch is U.S. attorney for the Eastern District of New York.

LORETTA LYNCH: We are here today to announce the filing of criminal charges against HSBC Bank, both its U.S. entity, HSBC U.S., and the parent HSBC group, for its sustained and systemic failure to guard against the corruption of our financial system by drug traffickers and other criminals and for evading U.S. sanctions law. HSBC, as you know, is one of the largest financial institutions in the world, with affiliates and personnel spanning the globe. Yet during the relevant time periods, they failed to comply with the legal requirements incumbent on all U.S. financial institutions to have in place compliance mechanisms and safeguards to guard against being used for money laundering.

HSBC has admitted its guilt to the four-count information filed today, which sets forth two violations of the Bank Secrecy Act, a violation of the International Emergency Economic Powers Act, or IEEPA, and violation of the Trading with the Enemy Act. As part of its resolution of these charges, HSBC has agreed to forfeit $1.256 billion, the largest forfeiture amount ever by a financial institution for a compliance failure.

AMY GOODMAN: That was U.S. Attorney Loretta Lynch.

Meanwhile, HSBC Group Chief Executive Stuart Gulliver said in a statement, quote, "We accept responsibility for our past mistakes. We have said we are profoundly sorry for them." He added the bank had, quote, "taken extensive and concerted steps to put in place the highest standards for the future."

News of HSBC’s fine comes as three low-level traders were arrested in London as part of an international investigation into 16 international banks accused of rigging a key global interest rate used in contracts worth trillions of dollars. The London Interbank Offered Rate, known as Libor, is the average interest rate at which banks can borrow from each other. Some analysts say it defines the cost of money. The benchmark rate sets the borrowing costs of everything from mortgages to student loans to credit card accounts.

Well, for more on the latest bank scandals, we’re joined by Matt Taibbi, contributing editor for Rolling Stone magazine. His latest book is Griftopia: A Story of Bankers, Politicians, and the Most Audacious Power Grab in American History.

Now, how did Forbes put it, Matt? "What’s a bank got to do to get into some real trouble around here?"

MATT TAIBBI: Exactly, exactly. And what’s amazing about that is that’s Forbes saying that. I mean, universally, the reaction, even in—among the financial press, which is normally very bank-friendly and gives all these guys the benefit of the doubt, the reaction is, is "What do you have to do to get a criminal indictment?" What HSBC has now admitted to is, more or less, the worst behavior that a bank can possibly be guilty of. You know, they violated the Trading with the Enemy Act, the Bank Secrecy Act. And we’re talking about massive amounts of money. It was $9 billion that they failed to supervise properly. These crimes were so obvious that apparently the cartels in Mexico specifically designed boxes to put cash in so that they would fit through the windows of HSBC teller windows. So, it was so out in the open, these crimes, and there’s going to be no criminal prosecution whatsoever, which is incredible.

JUAN GONZÁLEZ: And emails found where bank officials were instructing officials in Iran and in some other countries at how best to hide their efforts to move money into their system?

MATT TAIBBI: Exactly, yeah, and that’s true at HSBC, and apparently we have a very similar scandal involving another British bank, Standard Chartered, which also paid an enormous fine recently for laundering money for—through Iran. This, again, comes on the heels of the Libor scandal, which has already caught up two major British banks—the Royal Bank of Scotland and Barclays. So, you have essentially all of the major British banks now are inveigled in these enormous scandals. We have a couple of arrests, you know, today involving low-level people in the Libor thing, but it doesn’t look like any major players are going to be indicted criminally for any of this.

JUAN GONZÁLEZ: And this whole argument that the bank is too big to indict because of the threat to the world financial system, most people don’t know that HSBC stands for Hong Kong and Shanghai Banking Corporation. It’s a British bank that goes back to the early days of British colonialism in Asia.

MATT TAIBBI: Sure.

JUAN GONZÁLEZ: And is it too big to be indicted?

MATT TAIBBI: The amazing thing about that rationale is that it’s exactly the opposite of the truth. The message that this sends to everybody, when banks commit crimes and nobody is punished for it, is that you can do it again. You know, if there’s no criminal penalty for committing even the most obvious kinds of crimes, that tells everybody, investors all over the world, that the banking system is inherently unsafe. And so, the message is, this is not a move to preserve the banking system at all. In fact, it’s incredibly destructive. It undermines the entire world confidence in the banking system. It’s an incredible decision that, again, is met with surprise even with—by people in the financial community.

AMY GOODMAN: On Tuesday, Thomas Curry, head of the Office of the Comptroller of the Currency, the lead regulator for HSBC in the U.S., defended the settlement.

THOMAS CURRY: These actions send a strong message to the bank and to the financial services industry to make compliance with the law a priority to safeguard their institutions from being misused in ways that threaten American lives.

AMY GOODMAN: That’s Thomas Curry, head of the Office of the Comptroller of the Currency. It seems like a lot of people who are in prison right now—low-level thieves, criminals, drug launderers, people who have been accused of working with al-Qaeda—perhaps could appeal their convictions now and get out of jail.

MATT TAIBBI: Right. Right, yeah, exactly. I was in court yesterday, in criminal court in Brooklyn. I saw somebody come out of—come into court who had just been overnight in jail for walking from one subway car to another in front of a policeman. You can do real time in jail in America for all kinds of ridiculous offenses, for taking up two subway seats in New York City, if you fall asleep in the subway. People go to jail for that all the time in this country, for having a marijuana stem in your pocket. There are 50,000 marijuana possession cases in New York City alone every year. And here we have a bank that laundered $800 million of drug money, and they can’t find a way to put anybody in jail for that. That sends an incredible message not just to the financial sector but to everybody. It’s an obvious, clear double standard, where one set of people gets to break the rules as much as they want and another set of people can’t break any rules at all without going to jail. And I just don’t see how they don’t see this problem.

JUAN GONZÁLEZ: Well, Matt, Assistant Attorney General Lanny Breuer outlined some of HSBC’s alleged drug cartel ties.

ASSISTANT ATTORNEY GENERAL LANNY BREUER: From 2006 to 2010, the Sinaloa cartel in Mexico, the Norte del Valle cartel in Colombia and other drug traffickers laundered at least $881 million in illegal narcotics trafficking proceeds through HSBC Bank USA. These traffickers didn’t have to try very hard. They would sometimes deposit hundreds of thousands of dollars in cash in a single day into a single account, using boxes, as Loretta said, designed to fit the precise dimensions of the tellers’ windows in HSBC’s Mexico branches.

JUAN GONZÁLEZ: Matt, this is like Monopoly, the board game, all over again, you know? Get out of jail free, you know.

MATT TAIBBI: Yeah.

JUAN GONZÁLEZ: Instead of $50, you pay $1.9 billion, but you’re still getting out of jail free.

MATT TAIBBI: And this fits in the—in with the pattern of the entire financial crisis. $1.9 billion sounds like a lot of money, and it definitely is. It’s a record settlement. No bank has ever paid this much money before. But it’s about two months’ worth of profits for HSBC. It’s not going to cripple this bank. It’s not even going to hurt them that badly for this year. It fits in line with the Goldman Sachs settlement in the Abacas case, which was hailed at the time as a record settlement. It was $575 million. But that was about 1/20th of what they got just through the AIG bailout. So, this is not a lot of money for these people. It sounds like a lot of money to the layperson, but for the crimes they committed, getting away with just money—and it’s not even their own money, it’s not their personal money, it’s the shareholders’ money—it’s incredible. It really—it literally is a get-out-of-jail-free card.

JUAN GONZÁLEZ: And, of course, the way that big banks these days can borrow money from the U.S. Fed for no interest—

MATT TAIBBI: For free.

JUAN GONZÁLEZ: For free.

MATT TAIBBI: Free.

JUAN GONZÁLEZ: Basically, they can just take money from the government and pay the government back.

AMY GOODMAN: What does the Justice Department, what does the Obama administration, gain by not actually holding HSBC accountable?

MATT TAIBBI: You know, I think—I’ve asked myself that question numerous times. I really believe—and I think a lot of people believe this—that the Obama administration sincerely accepts the rationale that to aggressively prosecute crimes committed by this small group of too-big-to-fail banks would undermine confidence in the global financial system and that they therefore have to give them a pass on all sorts of things, because we are teetering on the edge of a problem, and if any one of them were to fall out, it would cause a domino effect of losses and catastrophes like the Lehman Brothers business. And I think they’re genuinely afraid of that. And so, that’s the only legitimate explanation that you can possibly assign to this situation, because, as we know, Wall Street abandoned the Obama administration this year when it came to funding in the election. They heavily supported Mitt Romney and didn’t give Obama much money at all.

AMY GOODMAN: We have to break, and when we come back, we’re going to ask you more about Libor and also your piece, "Jim DeMint," who’s stepping down in the Senate, "The Fireman Ed of Politics," you write. We’re talking to Matt Taibbi, contributing editor for Rolling Stone magazine. Then Peter Coyote joins us in studio to talk about the case of Leonard Peltier, in prison for 37 years. Stay with us.

The original content of this program is licensed under a Creative Commons Attribution-Noncommercial-No Derivative Works 3.0 United States License. Please attribute legal copies of this work to democracynow.org. Some of the work(s) that this program incorporates, however, may be separately licensed. For further information or additional permissions, contact us.

Users browsing this forum: No registered users and 3 guests