Bloomberg on the T-bill purchases by the Fed. Note that the purchases are coming after a reduction of T-bills on the Fed balance sheets of $240 billion in a year, so there's supposedly room for them to do this, and they're selling it as a stimulus measure to pump in cash, but in light of T-bill yields currently being so low and a 1.8 trillion dollar deficit planned it's hard not to interpret it as a desperation move to keep the US debt financed. Apparently China after raising its T-bill holdings by 46% last year is now losing money on these and complaining. They're also putting up another $750 billion in cash for trash securities (TALF), which is being treated almost as a sidelight!

Not that I can predict the course of a financial crash unprecedented in scope and scale, but this looks to me like it's quickly turning into the proverbial snake eating its tail, another sign that the biggest drama is imminent. (Actually, I'm one who believes governments should issue currency rather than incur debt, under a different monetary system altogether, but how can they justify this and prevent capital flight in the terms of the system until now? The dollar's fallen again to $1.31 to the euro from $1.24 last week.)

http://www.bloomberg.com/apps/news?pid= ... refer=home

Treasuries Surge as Fed Expands Purchases to Include U.S. Debt

By Dakin Campbell and Susanne Walker

March 18 (Bloomberg) -- Treasury 10-year note yields fell the most since 1962 as the Federal Reserve surprised investors with plans to purchase as much as $300 billion in government debt to drive consumer borrowing costs lower and lift the economy from recession.

The difference between two- and 10-year Treasury note yields narrowed 27 basis points to 1.75 percentage points, the most in at least 25 years, after the central bank said the purchases will be concentrated among those securities. The Fed is expanding the debt purchase portion of its quantitative easing policy, which already includes agency and mortgage debt, to about $1.75 trillion in securities.

“This is shock and awe,” said Steve Rodosky, the head of Treasury and derivatives trading at Newport Beach, California- based Pacific Investment Management Co., which runs the world’s largest bond fund. “The shoot first, assess later approach, with the economy teetering as it is, is the correct method.”

The yield on the benchmark 10-year note tumbled 53 basis points, or 0.53 percentage point, to 2.48 percent, at 4:36 p.m. in New York, according to BGCantor Market Data. It fell 54 basis points in January 1962. The price of the 2.75 percent security due in February 2019 surged 4 19/32, or $5.94 per $1,000 face amount, to 102 12/32.

The 30-year bond’s yield tumbled 32 basis points to 3.50 percent. Yields declined 24 basis points to 0.79 percent on two- year notes.

Treasuries had lost investors 3.4 percent since December, on course for the worst three-month period since the third quarter of 1980, when they fell 5.06 percent, according to a Merrill Lynch & Co. index. Investor concern about rising supplies of debt and gains in equities depressed prices, pushing yields up from record lows in the fourth quarter.

Consumer Rates

Investors have shunned debt backed by consumer loans as unemployment has climbed in the worst financial crisis since the Great Depression. Sales of the bonds plunged 40 percent last year to $106 billion, according to data compiled by Bloomberg, choking off funding to lenders. About $2.3 billion of debt backed by auto loans has been sold this year, compared with more than $9.6 billion in the same period of 2008, according to data from JPMorgan Chase & Co.

Central bankers and Treasury haven’t been able to meet Fed Chairman Ben S. Bernanke’s goal of reducing consumer interest rates along with the borrowing costs paid by banks. The difference between rates on 30-year fixed mortgages and 10-year Treasuries was 2.1 percentage points as of yesterday, Bloomberg data show. That’s up from an average of 1.75 percentage points in the decade before the subprime mortgage market collapsed.

‘Fed’s Willingness’

Bernanke trimmed the target rate for overnight loans between banks to a range of zero to 0.25 percent at the Dec. 16 policy meeting to help unfreeze credit markets.

“This demonstrates the Fed’s willingness to address this financial crisis,” said David Glocke, who manages $65 billion of Treasuries at Vanguard Group Inc. in Valley Forge, Pennsylvania. “It helps to reduce rates all over.”

The extra yield relative to benchmark interest rates that investors demand to own debt backed by consumer loans has soared amid concern that defaults will climb. Top-rated bonds backed by auto loans are trading at about 300 basis points more than the one-month London interbank offered rate compared with 65 basis points in January 2008, JPMorgan data show. One-month Libor, a borrowing benchmark, is currently 0.56 percent.

TALF Expansion

The central bank also said it will consider expanding the Term Asset-Backed Securities Loan Facility to include “other financial assets,” the central bank’s policy statement said. The Fed added that it will “increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion.

The Fed will buy $750 billion in mortgage-backed securities on top of the already-announced $500 billion program.

Treasury purchases will take place two to three times a week, and the Fed may also buy other maturity Treasuries and Treasury Inflation-Protected Securities, according to a statement on the Federal Reserve Bank of New York’s Web site.

Thirty-year bond yields fell to a record low of 2.509 percent on Dec. 18, less than three weeks after Bernanke first mentioned the option of buying Treasuries. Yields had climbed to as high as 3.84 percent today.

Strategists at primary dealers UBS AG, Bank of America Corp., Morgan Stanley and Goldman Sachs Group Inc. had forecasted that central bank policy makers wouldn’t provide plans to purchase U.S. debt.

On target as always!

‘Powerful Bullet’

‘‘We thought it was a lower probability event, but we always knew that if the Fed did use this clearly powerful bullet, it would cause a huge drop in yields,” said Suvrat Prakash, an interest-rate strategist in New York at BNP Paribas Securities Corp., another primary dealer.

Yields on 10-year Treasury notes rose 33 basis points in the two days after the last policy meeting Jan. 28, when the Federal Open Market Committee said the central bank might buy longer-term Treasuries to revive lending but gave no further details.

During World War II, the central bank agreed to purchase unlimited amounts of government obligations from banks to keep interest rates low to finance the war, according to the Federal Reserve Bank of Atlanta.

Prior to cutting interest rates near zero, the New York Federal Reserve Bank bought and sold Treasuries almost daily to manage money supply and keep the Fed’s rate for overnight loans between banks near its target. The Fed held $474.6 billion of Treasuries on its balance sheet on March 11, $234.5 billion less than the year-ago period.

Global Central Banks

Expectations for U.S. purchases of Treasuries increased when the Bank of England said March 5 it would buy gilts. Yields on 10-year U.K. government bonds fell to a more than 20-year low of 2.93 percent March 13, from 3.64 percent before the policy was announced.

The Bank of Japan’s decision today to raise monthly purchases of government bonds to 1.8 trillion yen ($18.3 billion) added to the speculation.

“It’s wonderful for Treasuries,” said David Coard, head of fixed-income trading in New York at Williams Capital Group, a brokerage for institutional investors.

Buying Treasuries may help support President Barack Obama’s pledge on March 14 that investors can have “absolute confidence” in Treasuries. Chinese Premier Wen Jiabao said the day before he was “worried” about holdings of Treasuries and wanted assurances that the investment is safe.

China, the biggest foreign holder of U.S. debt, increased Treasury holdings by 46 percent in 2008and now hold about $740 billion, according to Treasury Department data.

To contact the reporters on this story: Susanne Walker in New York at swalker33@bloomberg.net; Dakin Campbell in New York at dcampbell27@bloomberg.net

Last Updated: March 18, 2009 16:38 EDT

Fed's Announcement Today

http://www.businessinsider.com/the-fed- ... lar-2009-3

Release Date: March 18, 2009

For immediate release

Information received since the Federal Open Market Committee met in January indicates that the economy continues to contract. Job losses, declining equity and housing wealth, and tight credit conditions have weighed on consumer sentiment and spending. Weaker sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories and fixed investment. U.S. exports have slumped as a number of major trading partners have also fallen into recession. Although the near-term economic outlook is weak, the Committee anticipates that policy actions to stabilize financial markets and institutions, together with fiscal and monetary stimulus, will contribute to a gradual resumption of sustainable economic growth.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months. The Federal Reserve has launched the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses and anticipates that the range of eligible collateral for this facility is likely to be expanded to include other financial assets. The Committee will continue to carefully monitor the size and composition of the Federal Reserve's balance sheet in light of evolving financial and economic developments.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen.

I also watched the video recommended by MWB in another thread:

60 Minutes on Alt-A and ARM Resets

http://www.newmogul.com/item?id=7196

Apparently the automatic "resets" due on these low initial-rate mortgages issued in 2005-2006 at the height of the bubble are still mostly coming, and their volume exceeds that of the subprime loans! They are currently defaulting at the same high 10-percent-plus rate as subprimes and were turned into marketable securities with credit-default swap derivatives sold on them, exactly as with the subprime mortgages, so according to the report, we're only about HALFWAY through the crash of financial instruments following from mortgage foreclosures. And never mind credit cards, car loans, etc. Same story there.

I also watched David Harvey, Marx scholar, present an excellent short lecture on:

The crash as financial Katrina

Oct. 29, 2008

http://davidharvey.org/2008/12/a-financ ... he-crisis/

Download (about 30 mins.) at http://davidharvey.org/media/A_Financial_Katrina.mp3

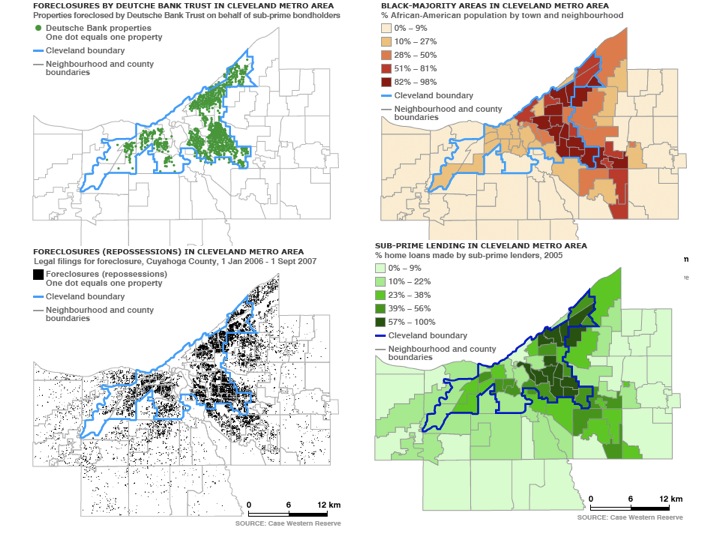

He employs slides of the foreclosure patterns on subprime mortgages in Cleveland, compared to African-American neighborhoods.

This was happening without intervention from the government, thus his metaphor of a financial Katrina. But of course Paulson and Bernanke stepped in to cover for the banks at 10 times or more the cost of covering the original mortgages. Harvey shows how property asset inflation has always been a favored method of covering for excess liquidity (i.e., when there's growth and nowhere else to put the money, it goes into higher housing prices).

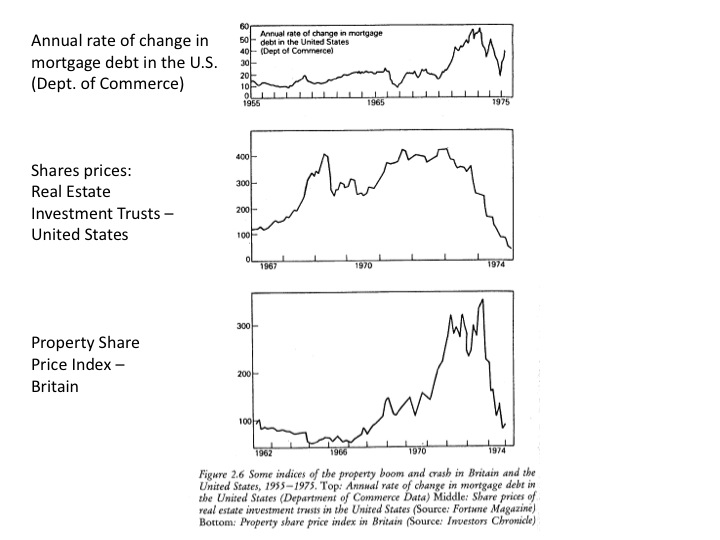

Harvey reviews earlier property crashes with very similar mechanics in the Netherlands, Second-Empire France, and in the 1970s in the United States:

Look at that! The same exact insane ups and downs as you'd see in the years of the present property bubble and crash.

This really puts the lie to the bullshit we're still peddled daily about how the traders and operators of the financial sector simply guessed wrong in their honest assumption that housing prices would keep rising like crazy, forever. I heard a liar doing that today on NPR, she actually said that housing prices had never gone down before, citing data of the national mortgage association (or some such) that, she said, they started collecting in... 1979! Now isn't that convenient?

Harvey also puts it all in the context of neoliberalism as class war. I, like, totally recommend this lecture as an excellent overview.

.