.

Just to provoke the bejaysus out of you clan of hypers, here's Mike Whitney's pretty good reasoning of factors militating against a hyperinflation scenario. He also exposes the uselessness of QE as a an economic strategy. Cumulative demand stimuli and monetary easing are just never going to work; this beast needs pump-priming by way of direct public investment in jobs. Other measures within the capitalist paradigm aren't going to do shit.

Note that clearly he agrees that many prices are going up -- of the necessities we little chumps need to live. The question is whether a dollar meltdown is going to happen, and whether the economic/financial/fiscal/monetary climate as a whole points up or down on prices.

In my view he misses at least three big issues, two of which run counter to his case:

1) What the markets think about US Treasuries as a risk or a safe haven may not matter; as we've seen over and over in our discussions, it's likely that there will just be too many of them for markets to absorb. The Fed is therefore going to keep buying them.

2) Commodity inflation. Hello. Just how the peaking of oil is going to express itself, year by year, can change all considerations overnight. This will be a question of physics and geology, not capitalist economics.

3) One thing he could have said in support of his case: Hyperinflation hysteria feeds into the current fashion to describe the US problem as deficit or debt, supporting the class war from above and avoiding issues of bankster rule and the inevitable, predictable and intractable crises of capitalism.

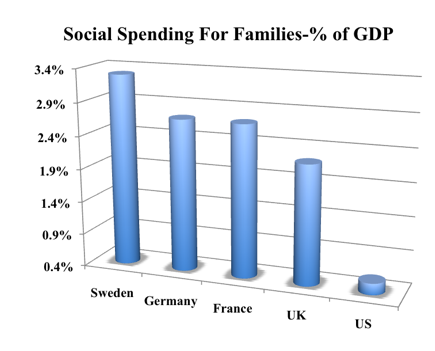

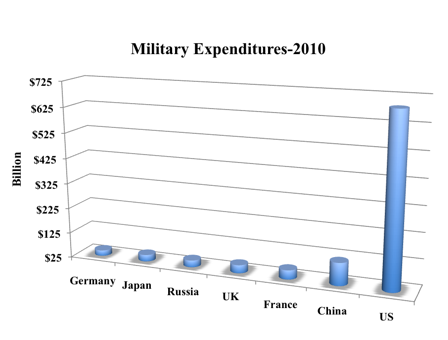

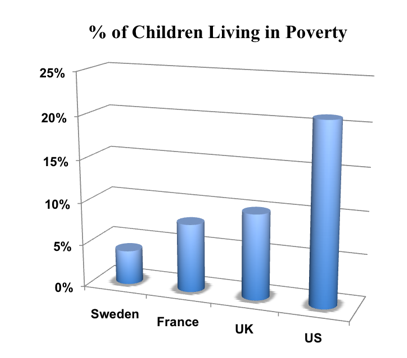

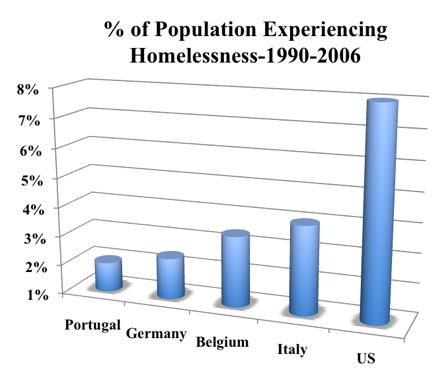

The deficit is of course a problem; but it's not a cause. The diseases causing it are class war, almost all disposable wealth hoarded in the hands of the richest and the multinationals, offshore havens, skewed investment priorities, tax policy, spending on war and banksters, and the deficiency of the health and social insurance system.

http://www.counterpunch.org/whitney04272011.html

April 27, 2011

Don't Invest in Wheelbarrows for Toilet-Paper Greenbacks

Hyperinflation? No Way

By MIKE WHITNEY

The Federal Reserve is not going to push the economy into Zimbabwean hyperinflation. That's pure bunkum. The Fed's plan is to weaken the dollar to boost exports and to force China to let its currency appreciate to its fair-market value. By purchasing $600 billion in US Treasuries (QE2), the Fed effectively reduces the supply of risk-free assets, which sends investors into riskier assets like stocks and commodities. Is there an element of class warfare in the policy?

You bet there is. It's a direct subsidy to the investment class while workers are left to face higher prices on everything from gasoline to corn flakes. It's a royal screw job. But while Ben Bernanke may be a prevaricating class warrior and a charlatan, he's not insane. He's not going to shower the nation with increasingly-worthless greenbacks like they were confetti.

While rising headline inflation (gas and food) is painful for workers and people on fixed income, it actually intensifies the downturn by diverting money from other areas of consumption. So, discretionary spending falls and the economy begins to contract. It's more proof that we're in a Depression. And, yet, every day more ominous-sounding articles pop up warning of "The End of America" or "Gold to Soar to $10,000 per ounce" or some other such nonsense. \ Gloom and Doom has become a cottage industry employing a thriving class of worrywarts who all preach from the very same songbook.

Memo to Inflationists: The economy is not moving. Yes, the Fed can tie QE strings around the hands and feet and make them move like a marionette, but it's all make-believe. Without the props and the support-system, the economy would drop to its knees, gasp for air, and expire. Dead.

Have you noticed that 1st Quarter GDP has been revised-down to 2 percent and could be headed lower still? (Maybe even negative!) Have you noticed that unemployment is stuck at 8.8 percent and underemployment at 16.2 percent with more people falling off the rolls and into abject poverty every day? Did you see that manufacturing is starting to slip and "the production index, a key measure of state manufacturing conditions, fell from 24 to 8, indicating slower growth in output." Do you realize that the downturn in housing is getting more ferocious even after falling steadily for 5 years straight? Have you considered the fact that the government and Fed have pumped trillions of dollars of monetary and fiscal stimulus into the financial system with just about nothing to show for it? And, do you know why? Because we're in a Depression, that's why.

It's ridiculous to wail about "money supply" when velocity is zilch. It's pointless to crybaby over "bank reserves" when people are broke. It's crazy to yelp about "printing presses" when lending is down, credit is contracting and the economy is mired in the most vicious slump in 80 years. We're in a liquidity trap where normal monetary policy doesn't work. Keynes figured it out more than 60 years ago, but since Bernanke is so much smarter than Keynes, we get to relearn it all over again. Now that QE2 is ending, the verdict is in. And what have we learned? That monetary policy doesn't work in a liquidity trap.

The hullabaloo about inflation is vastly overdone. China's not going to dump its $3 trillion stockpile of mainly USD and US Treasuries. Who started that cockamamie story? China's doing everything it can just to keep its currency cheap just so to keep its people working. Are they suddenly going to do an about-face and commit economic harikari just to strike a blow against Uncle Sam? No way.

And, now the naysayers are worried that no one will buy Treasuries when QE2 ends in June. It's a possibility, but is it likely? Here's a piece from the Wall Street Journal that mulls over what will happen in June:

"The direction of interest rates after the Fed ends its bond-buying program is crucial for the economy. The issue will be in sharp focus this week, when Fed policy makers hold a two-day policy meeting, starting Tuesday, to discuss their efforts to steer the economy between the shoals of recession and inflation.

“They face an economy that has shown signs of losing momentum in recent months, with first-quarter economic growth now widely believed to be less than 2% annualized....

“One yardstick for the immediate future of Treasury yields after QE2 could be QE1, which included a $1.25 trillion Fed buying spree of mortgage bonds from late 2008 to March 2010. The mortgage-bond market felt barely a ripple when the Fed stopped buying. Treasuries, some observers reason, may follow the same path.

“Treasury yields ‘moved up significantly at the onset of QE1 but then fell precipitously when it ended,’ Mr. Rieder says. ‘So it's not a given that Treasury yields will rise this time either.’” ("Fund Giants Take Competing Stands On US Bond Outlook", Wall Street Journal)

True, that doesn't guarantee that yields won't rise when QE2 ends, but how high can they go when the economy is still stuck in the mud?

Not very high. And, who's going to buy Treasuries when the economy is "losing momentum"? The same people who always buy them when the economy starts to crater; investors looking for a "safe harbor" from falling stocks or deflation. Don't worry, there will be buyers. It's just a matter of price.

So, forget about inflation. It just diverts attention from the real issue, which is finding a way to dig out of the mess we're in and put people back to work. QE2 has been a total flop; we know that now. It's time to return to traditional fiscal policies that have a proven track record of success.

Mike Whitney lives in Washington state. He can be reached at fergiewhitney@msn.com