Questions about the stock market

Posted:

Thu May 20, 2010 5:56 pmby jingofever

What does it mean when some yahoo says, "key support levels?" The market is often breaking or testing those levels. I have the vague idea that this has something to do with 'technical analysis' which is derived from augury, but do these 'support levels' have any logic behind them? Do they represent something real? Those 'technical analysts' like to draw neat looking things on charts of the stock market but I suspect they're insane.

What is a handle? The same yahoo will say, "the S&P is down five handles today!" Is it like a klick? Is the S&P five klicks up shit creek?

Re: Questions about the stock market

Posted:

Thu May 20, 2010 6:59 pmby 82_28

Good question. I never have any fucking idea what the terminology means, I just see scams and trends of scams. All I know is 99% of everybody ain't gettin' jack shit, but the Dow is the most important number always on the news and it always has been. I don't know how those fuckers do it.

My ex-gf had a brother who lived in Manhattan. We cruised out there a couple years ago and stayed with them. All of his clown friends and wife and including him all had a fantasy stock league. I think this kind of nonsense is common to Manhattan and Chicago people. If they can't see the absurdity in a fantasy stock league, they're definitely not gonna see any absurdity in the "real" "markets".

(Ex's bros wife had just accepted a Lehman job. I wish I was around to see the crash)

Re: Questions about the stock market

Posted:

Thu May 20, 2010 7:01 pmby Wombaticus Rex

Sounds like you don't really want to know, though.

Re: Questions about the stock market

Posted:

Thu May 20, 2010 7:04 pmby JackRiddler

"Key support levels" and all the different math models of the market that look only at how the numbers developed and behaved in the past without regard to empirical factors are an example of group think reflecting on itself.

Re: Questions about the stock market

Posted:

Thu May 20, 2010 7:05 pmby 82_28

Wombaticus Rex wrote:Sounds like you don't really want to know, though.

Sure I do. Explain it or else I'm going back to that Cydonia thread for the rest of my life.

Re: Questions about the stock market

Posted:

Thu May 20, 2010 7:09 pmby barracuda

A support level indicates a point on the chart where the price is unlikely to fall below, usually determined by historical trends or psychological barriers.

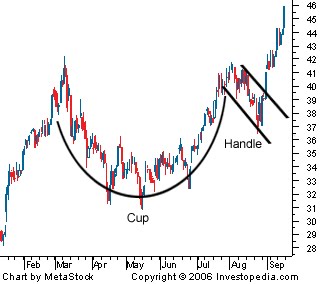

A handle is part of a chart configuration known as a

cup and handle. Handles are usually supporting areas. When they drop out, it means trouble sometimes.

At least I think that's what they mean. It's all just such a snafubar these days, anyway. Welcome to Cydonia.

Re: Questions about the stock market

Posted:

Thu May 20, 2010 7:40 pmby Nordic

Personally I think the support level on the dow is, oh, around 6,000.

That's about all it's worth.

Nobody believes me.

Just a couple of weeks ago I was on a job and I was amazed to learn that a lot of people STILL had money in the stock market. WTF! I try to tell people, they don't want to hear it. These people have now "lost" quite a bit of money.

This might be the biggest sucker rally in history (the one that's ending now apparently).

I wish it would get itself over with. The other shoe has to drop for any true change to happen. People have to be fucking broke, and angry, and willing to actually CHANGE shit. They have to quit thinking of these drops as a "buying opportunity". That just prolongs the inevitable.

Re: Questions about the stock market

Posted:

Thu May 20, 2010 8:00 pmby Wombaticus Rex

82_28 wrote:Wombaticus Rex wrote:Sounds like you don't really want to know, though.

Sure I do. Explain it or else I'm going back to that Cydonia thread for the rest of my life.

!!!!!It's about resolution. Us plebs see the market as unbroken lines, but it's not. When people are watching the market second to second, those unbroken lines break into something else: the "Candlestick" chart.

http://en.wikipedia.org/wiki/Candlestick_chartYou're right that support is voodoo to a certain extent. But it's also based on actual math, and it's right often enough to be useful.

The Candlestick Chart is designed that way because

pricing is never uniform in these markets - you will have hundreds of trades in the same instrument/stock/commodity, all at different prices. So the chart is structured to reflect that. Moment to moment, there's a distribution of values.

"Support" is the assumed "real value" bottom boundary. Even if things go to shit and the speculation goes horribly wrong, the "Support" is where the nerds assume the index (Dow Jones, S&P, NYSE) will return to.

"Resistance" is the assumed top boundary. In my limited experience, I see a lot more daily, hands-on reality application and vindication of "Resistance" than I do for "Support". I suspect that's because of what Nordic ID'd in the post above: the "Resistance" numbers are a reflection of psychology -- aka, nobody is willing to buy stock at that price because it just looks insane.

On the other hand, "Support" is supposed to be based on fundamentals, the actual value and productivity of the market...and that's more of a holographic projection from WSJ + CNBC than anything else. There IS no bottom, no safe boundary, no support, because the market is pumped up exponentially far above anything resembling actual value.

This is why "Fundamental Analysis" specialists are so frustrated these days.

"Fundamental Analysis is about what the market should do. Technical Analysis is about what the market is actually doing."Oh, and yes, if someone is talking about multiple handles, they're full of shit and mouthing empty jargon. It's a chart movement, not a unit of measurement.

Re: Questions about the stock market

Posted:

Thu May 20, 2010 8:35 pmby nathan28

Don't listen to all those doomers. The S&P has key support levels in the high zeros. Buy now.

"Support" is a price level a stock has repeatedly fallen to then risen from, so that you could draw a line at that price level and it would look like the chart bounces off it. "Resistance"--which you never hear mentioned on BuyNowSPAN--is the opposite, a price-point a stock can't seem to get above. These levels can be a little fuzzy. In theory, the longer or older the support/resistance level is, the more dramatic the movement should be once it is broken. In theory. Like right now Dow 10,000 or so is both major support and also going to be called "psychological" support, too.

"Five handles" means the dude has been drinking with Larry Kudlow again.

What this means in the real world is that a lot of people are buying and selling at those points--IOW, a lot of people are getting their money chewed up by churning prices, and the brokers are rolling in commissions. There's a saying somewhere that a stock only moves past support or resistance when all the short-term dumb money--i.e., retail players, small funds, investing clubs, other people w/out bloomberg machines--has been spent. There's a corollary (?) that follows from that, that a market or stock will only turn around when all the dumb money is fully invested in the wrong positions and that the actual market makers will create historic highs or lows to ensure this happens.

Support is a term from "technical" analysis, which is basically a bunch of horseshit--but oddly enough, so is the only other form of stock analysis, "fundamental" analysis. Technical analysis looks at price charts and volume, IOW, it's staring at numbers and charts with your autism glasses on. There's some specious stuff about fibonacci numbers and "waves" etc. that claim to be tied into the natural mathematical patterns of social behavior or whatever but hey, sometimes I like to take stimulants with my weed, too. Fundamentals look to "fundamentals," shit (that's what it is) like price (of the shares taken in gross)-to-earnings, profit levels, demand, future availability, social trends etc. Technical analysis doesn't pay attention to anything but numbers.

An example of fundamental analysis would be, say, assuming that a BP well was going to blow the fuck up tomorrow and then shorting ("borrowing" the shares to earn money from the price decline when you "return" them) the stock. Or looking at BP's balance sheet, determining that they're still profitable and that the price will eventually return to higher levels, and buying it to sell later. Technical analysis would be waiting for BP's price to hit a short-term low, shorting it, then selling it when it hit a lower intermediate term low, regardless of whether they clean up the spill tomorrow and suddenly get a no-bid contract on all the remaining oil on the globe.

Most of the CNBC "approach" you hear on that channel is a nonsense mix of sentiment, Pollyana-ism, guessing and flag-waving horseshit. Jim Kramer is the poster boy for this idiocy, which has been termed "specuvesting" because it can't figure out if it's a speculative play or a long-term investment.

I tend to think technical analysis "works" because it allows you to determine a viable entry point, a stop-loss level and an exit point before hand. IOW, it's systematic, it's a plan, a strategizing tool. You can use it to pursue large, longer-term moves ("trend following") or you can use it to profit from short-term choppiness ("swing trading") (but probably not both at the same time). I think the chart patterns are largely full of shit, because like WR says, they're not units of measurement, and there's so many "patterns" it's like seeing faces in clouds.

Don't, however, assume I think that fundamental analysis works. Warren Buffet isn't a fundamental analyst. He buys controlling shares in companies and takes over them. Not the same thing, dawg, not by a long shot. You're fucking retarded if you think that you, a spreadsheet and some guesses you have about the future can figure out how much a company's shares will sell for when you don't work at Goldman Sachs.

Re: Questions about the stock market

Posted:

Thu May 20, 2010 9:52 pmby Wombaticus Rex

Fibonacci Retracement is not spurious -- or rather,

I don't think it is. I find it to be pretty remarkable, in fact.

The markets are irrational and rigged by design, so technical analysis is the closest thing to a roadmap we have.

Edit - wow, I should have just posted this and not typed anything...

Re: Questions about the stock market

Posted:

Thu May 20, 2010 10:55 pmby justdrew

82_28 wrote:Wombaticus Rex wrote:Sounds like you don't really want to know, though.

Sure I do. Explain it or else I'm going back to that Cydonia thread for the rest of my life.

ya know, your username, 82_28, is: <year_of_PKD's_death>_<year of PKD's_birth>

was that intentional? (probably not but FYI

)

Re: Questions about the stock market

Posted:

Thu May 20, 2010 10:57 pmby Nordic

Just FYI, I checked in over at zerohedge.com, and good old Tyler Durden is going far beyond any doom and gloom I've ever seen:

I wasn’t going to write this week so this will be extremely brief. The entire charade that has been propagated on humanity is coming completely unglued and there is absolutely no stopping it. I have only one request to those that are reading this. If you know of specific incidences of corruption or serious wrong-doing come forth and tell everyone now. This is your last chance. When this things breaks the 99% of people on this planet that have been unwilling victims of a very small group of elitist political and corporate players and others will be so completely destroyed they are going to go after people and in a very serious way. This must be done calmly and without violence but it must be done and it will be done. At that point the backstabbing and selling out by people that previously held alliances with one another will be so chaotic it is going to be tough to separate those did the most harm from those that were willfully ignorant. I fear that being willfully ignorant will not be a defense that will appease many so it is best to come out before that point is reached. For those that have read A Tale of Two Cities or just generally know your history remember what happened in the aftermath of the French Revolution. There was illogic and indiscriminate punishment applied in many cases. I hope this never happens and I will fight to prevent it all the way but the best thing one can do now is come clean if there is anything you need to come clean about. Bob Dylan said it best in the quote at the top. This is the chance. Do not let it pass you by because of fear or greed. Truth is all that matters. - Mike Krieger

http://www.zerohedge.com/article/time-speak-out

http://www.zerohedge.com/article/time-speak-out

Re: Questions about the stock market

Posted:

Thu May 20, 2010 11:08 pmby JackRiddler

Wombaticus Rex wrote:Fibonacci Retracement is not spurious -- or rather,

I don't think it is. I find it to be pretty remarkable, in fact.

The markets are irrational and rigged by design, so technical analysis is the closest thing to a roadmap we have.

Edit - wow, I should have just posted this and not typed anything...

That may show only that players are paying attention and self-fulfilling the price support. No one wants to get killed trying to break it when everyone knows it's supposed to be there and expecting the rest to act like a herd. As I said, it's group think reflecting on itself. Fascinating.

("i'm betting you don't know yet that I know that you know that I know that you know")

Re: Questions about the stock market

Posted:

Thu May 20, 2010 11:28 pmby justdrew

we should ban all stock except for dividend paying shares with voting rights. No share of stock may changes hands more than once per day. and have a 1% tax on the money changing hands. Shareholders should be loath to see companies increasing stock volume. Most of the money currently after stocks should instead go to corporate bonds, and federal/state/municipality bonds.