Moderators: Elvis, DrVolin, Jeff

Sounder wrote:It's revealing to see words, with quote marks around them, taken as my words, and therefor seen as worthy of challenge. At any rate, it makes me feel better about my confusion.

Sounder wrote:MMT, it will mean nothing if the Govt. continues to pay interest for every dollar it appropriates or creates.

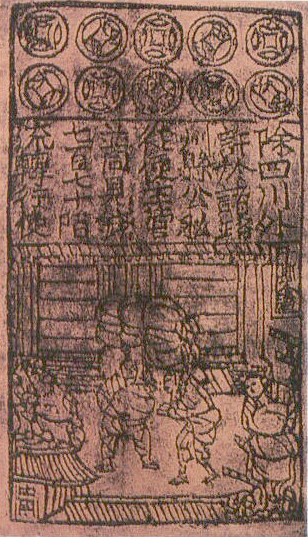

During the 13th century, Marco Polo described the fiat money of the Yuan Dynasty in his book The Travels of Marco Polo.[18][19]

All these pieces of paper are issued with as much solemnity and authority as if they were of pure gold or silver... and indeed everybody takes them readily, for wheresoever a person may go throughout the Great Kaan's dominions he shall find these pieces of paper current, and shall be able to transact all sales and purchases of goods by means of them just as well as if they were coins of pure gold.— Marco Polo, The Travels of Marco Polo

link

Sounder » Fri Jun 14, 2019 5:56 pm wrote:Jack, probably we have different ideas of what it is to be a troll. From my side it is trollish to call a valued member that was contributing great material on the now dead 'Govt. rules on gender identity thread', an anti-intellectual,

and top it off by starting a thread about Heaven Swan falling for some honeypot op that professes to reconcile left and right.

Heaven Swan introduced me to many things I would otherwise not have considered and I miss her. You make me laugh, but other folk don't take it so well.

Finally, you have not responded to my reply to you in this thread, this time I expect one.

http://neweconomicperspectives.org/2012 ... cle_inline

MMP Blog #51: The Efficiency Fairy and Inflation Goblins

Posted on June 17, 2012 by Mitch Green | 94 Comments

By L. Randall Wray

The main objection to MMT is the belief that adoption of a fiat money necessarily leads to high inflation if not to hyperinflation. Those who adopt this critique usually see MMT as a proposal, although some (like Paul Samuelson) recognize that MMT actually describes the system we already have. The latter group fears that if we tell the truth about the existing monetary system, then elected officials will “run the printing presses” to create high inflation. Hence, best to adopt what Samuelson described as the “old time religion” of lies about the fiscal options open to sovereign government to keep the inflation goblins at bay.

Aside from the fear of inflation, the second biggest bogeyman is efficiency—that is to say, lack thereof. This is mostly applied to MMT’s promotion of the job guarantee, but it also applies more generally to the MMT belief that government has a positive role to play in the economy. Government is said to be inherently inefficient, and particularly so when it comes to employing labor. Only the “free” market is capable of using “scarce” resources in the most efficient manner. Anything government does is bound to be less efficient, so the first preference is always to rely on the efficiency fairies of free enterprise. Adopting the JG gives us the worst of both worlds: higher inflation plus lower efficiency. It is better to leave people unemployed where they can help to fight inflation and inefficiency in a reserve army of the unemployed. The best use of the unemployed is to keep them unemployed.

For the few bleeding heart liberals in this camp, the suffering of the unemployed can be relieved in the most efficient manner by simply providing welfare (perhaps in the form of a BIG—basic income guarantee). Their higher income is then spent in the “free” market which more efficiently uses labor to efficiently produce the consumption goods our unemployed want. Besides, it is claimed, many (most?) people really don’t want to work, so the BIG incomes allow people to choose to do what they prefer, while the efficiency fairies ensure we’ve got all the goodies people want to consume. Through BIG, we get to keep low inflation plus high efficiency with the added benefit of a life of leisure for anyone who wants it.

Now, of course, the MMT+JG response to this has been that unemployment, itself, is a massive waste of our most valuable resource, labor. Unemployment destroys lives, families, and communities. It is bad for physical and mental health. It promotes crime, ethnic division, and even terrorism. It is hard to conceive of a JG program so badly designed that it does not reduce waste. Further, the JG by design helps to stabilize prices, by providing a wage anchor. The employed bufferstock is much better than the reserve army of the unemployed. And our view is that most people want to be productive members of society—and like it or not, ours is a capitalist society in which there is a strong ethical imperative to “earn” one’s keep. But our critics are not swayed.

Before digging deeply into the topic of efficiency, let’s look at a couple of examples.

First, a purely hypothetical one. Let us say we’ve got a society of 150 people, of whom 100 work and 50 are dependent aged and young who do not work. The total output produced by the 100 workers is allocated through some mechanism (perhaps a market, perhaps through equal shares) to the entire population of 150. For simplicity, assume only one product is produced and consumed; call it corn. A study is undertaken to determine the productivity of workers, which finds (horror of horrors!) some workers are less productive than others—measured by quantity of corn produced per hour of work. It is decided to lay-off the 20 least productive workers in the interest of increasing efficiency. We now have 80 workers to produce corn for the population of 150. Since these 80 were more productive than the now unemployed workers, total output did not fall by a full 20%, but clearly there is less output to share. Only if we get the 80 “efficient” workers to work longer or harder will this society be able to consume as much as before. The 20 “inefficient” workers are now producing nothing.

In what meaningful sense have we increased this society’s “efficiency”?

Second, a trip to the doctor. I heard on NPR a couple of weeks ago about a study of the typical office visit (which matched quite well my own experience); unfortunately I do not recall the exact statistic but what follows is close. The doctor asks the patient some form of the following: “So, what is wrong?” (or, in my case, my doc always asks “So, what are your concerns?”). The doctor listens for an average of 9 seconds, then intervenes with a prognosis. The amount of time the doctor is willing to listen before intervening has gone down over time, presumably as health insurers have pressured doctors to increase throughput and as they have greatly increased the amount of paperwork required of doctors. In other words, it is in the name of efficiency. The efficiency fairies are at work in the doctor’s office to eliminate all that wasteful time spent in creating a doctor-patient relationship.

This is also happening on university campuses, of course. Professors reduce their office hours—or skip them entirely—and send students to the much cheaper teaching assistants as the efficiency fairies work to preserve more time for faculty to spend doing all the paperwork required by a burgeoning administrator staff that has nothing better to do than to create new paperwork requirements.

If you think about it, an ever growing proportion of our labor force is engaged in the “care” services, and the efficiency fairies are trying to reduce the amount of care provided in the name of increasing productivity. Measured as what?

Whenever I hear an economist use the word “efficiency” (or “productivity”), I can guess with near 100% accuracy that he (it usually is a he, as I’ll explain below) hasn’t the slightest idea what he’s talking about. With rare exceptions, he is inappropriately applying an engineering term to an economic process he does not understand.

Return to our little corn model above. If the average worker produces 10 bushels of corn in a 10 hour day, we can measure productivity as a bushel per hour of labor input. It’s pretty simple, and it is a meaningful measure. It makes sense to try to increase average productivity—to increase the efficiency of the use of labor—to get to, say, two bushels per hour of labor input. All things equal, that’s desirable.

But if the only way to get the increased labor efficiency is to chop down all the trees, pollute the water, and destroy the view, then we might pause before concluding that this is really increased productivity. Sure, each labor input to the production process produces more corn, but that is a mismeasure of productivity if it also takes trees and water; further if the view matters to us then we have also mismeasured consumption.

(There is, of course, a whole field of economics that looks at “external” costs and benefits, and that argues that we need to help out our efficiency fairies by “pricing” goods and bads. While this is better than conventional economics that ignores the environment, I think it is still largely misguided—but that is not a topic for today.)

So even in our little corn model we encounter problems in using the engineering concepts of productivity and efficiency. But the real world is infinitely more complex, and the corn model is entirely misleading as a description of capitalist production even aside from the greater complexity. First, production is typically highly social, the result of integrated processes involving dozens or hundreds of workers producing multiple products using the output of other dozens or hundreds of workers. As Sraffa put it, we’ve got a system of production of commodities by means of commodities, each of which was produced by social labor. And of course it is even more complex than that because labor (or, more technically, labor power) is itself a commodity produced by means of commodities.

Think of a blue collar factory worker at her machine producing widgets. Put her at the top of a pyramid of humans who serve as a support staff. She’s got a doctor and a hospital infrastructure and staff that keep her healthy enough to stay on the job. Accountants with a team of assistants manage her finances and compute her tax bill for April 15. She’s got a pre-school to keep her youngest children off the streets so she can work; and an entire public school system to prepare her oldest kids from age 6 through to 22 or 28 years old so that they, can enter the workforce of the future. And there are construction companies building shopping malls for her, and the roads that will take her from home to work and to shopping. A fleet of jetliners stands ready to fly her to a sunny clime, where pool boys and cocktail waitresses ready things for her vacation. It takes thousands of pink and white collar service workers as well as blue collar workers to keep that worker at her job. And of course, she will use the inputs of agricultural and manufacturing workers to make the widgets at her machine.

What sense does it make to measure her productivity while ignoring all of these inputs? How can we say in any meaningful sense that she “produced” some specific number of widgets per hour of her labor?

Further, and here is the more important point, the widgets that flow out of her machine are not yet commodities. They become commodities only when they exchange for money-denominated IOUs. That will be the topic of the final blog, #52, so I won’t go into it in great detail here. But not only does she have a huge staff responsible for getting those widgets sold, but it makes no sense to measure her productivity in terms of widgets for the purposes of economic analysis. In other words, not only do the economists misunderstand the engineering concept of efficiency, they also misapply it. In our “monetary production economy” (A.K.A. “capitalism”) what matters are the monetary inputs and monetary outputs: how much money did the capitalist start with, and how much did she/he end up with?

Those market efficiency fairies could care less about widgets—what they want is money.

The capitalist uses the widget factory not to make widgets but to make monetary profits. He can increase profits through a variety of means: pay his workers less; pay his suppliers less; charge his consumers more; work his workers harder; replace the “less efficient” workers with “more productive” ones. In real world production processes—as discussed above—it is difficult if not impossible to assign productivity measures to individual workers. Further, workers are social beings with a great deal of discretion over how they approach the work process. Even mainstream economists have finally recognized this as they introduced concepts such as “efficiency wages” (surprise, surprise, if you pay workers more, they work harder and smarter!), “shirking” (work below capacity in low paid or otherwise undesirable jobs), and “insider/outsider” cooperation (union workers won’t cooperate with scab labor).

Happy workers make better team members, who lower production costs even if they are higher paid. The work environment matters.

Return again to our corn model, and presume distribution is based on a market with a monetary system and 20 unemployed workers. Our BIG proponents propose to provide monetary welfare to solve the problem. With their welfare, the unemployed workers can compete with the employed for a share of output; the extra aggregate demand and bidding up of prices might induce the 80 employed workers to work harder and longer to produce more bushels of corn to divide among the 150. Perhaps some jobs might be added for some of the less efficient workers.

So far as I can understand it, the BIG claim is that the market efficiency fairies will ensure enough new output is created by some combination of harder work by the 80 efficient workers plus some new jobs for some of the 20 less efficient workers so that welfare is not inflationary. However, in truth, the BIG proponents want to provide the welfare to all 150 members of the society so that no one is forced to work. But the efficiency fairies will ensure that sufficient corn is produced by the few who decide to continue to work so that the multitude who decide not to work can continue to consume at noninflationary prices.

Exactly how that works has not, to my knowledge, been explained.

But in any case, I cannot see why that would be less inflationary or more efficient than simply rehiring the 20 back into their old jobs, even if they are less efficient than the other 80 workers. Or if that is impossible (let us say corn production is undertaken by a capitalist who is concerned only with monetary outgo and income, thus, who refuses to hire the inefficient workers), then let us employ the 20 to plant trees, clean the water, and improve the view. In the worst case, we’ve got a bit less corn to be divided among the 150 (so there will be a higher price due to the decision to cut the labor force and output of the corn factory) but we’ve got more total consumption in the form of trees, clean water, and views than we would have if we left the 20 unemployed. At least we’ve got them producing something.

Let me finish up with a general observation on the obsession with efficiency fairies and inflation goblins.

It’s a male thing (mostly).

This became clear to me after a comment to the response to Blog 50 and as well a couple of columns by George Lakoff. The comment was by a ticked-off “aging, retired”, former entrepreneur who disparagingly remarked on Minsky’s career that he’d never had a “real” job and certainly could not understand much about unemployment because he’d never been a “job creator” like—let us say—Mit Romney. I’ve long admired the work of Lakoff on “framing”, and I think he’s really hit the nail on the head in his recent columns where he links conservative framing, worship of the market, and deference to the strict father figure.

The businessman plays a special role in our society. Virtually all public policy is formulated with a view to the reaction of our businessmen (I use the gender identification purposively).

Personally, I like the original term for capitalist, applied by the “father” of economics, Adam Smith, to the businessman: the “undertaker”. Today, we mostly limit the term to the capitalist engaged in the business of death, but I think it is appropriate to reclaim the term for all our capitalists. It is the undertaker who does most of the bidding of the efficiency fairies—continually striving to weed out the inefficient, the unproductive, the unfit.

He proclaims himself to be the “job creator”, but as we know, a good undertaker—like Mit–is a job destroyer. That is what the Darwinian process is supposed to do: increase efficiency by destroying jobs. It has long been understood—since the days of David Ricardo—that the “machine process” is a net job destroyer as we replace human labor with machines. It is true that new lines of business plus new markets open up job opportunities, but our undertakers will immediately begin to destroy as many jobs as they can in the quest to increase productivity. There is no market force to ensure that on balance new jobs are created more quickly than the undertakers can destroy them. And destroying jobs also destroys markets for the output of the remaining workers—so the natural market force is always destructive (Schumpeter called it “creative destruction”).

All of our undertakers really are in the business of death.

We like to view our undertaker as The Decider, the strict Father who efficiently manages our economic affairs. Because he has to “meet the payroll” he understands the nation’s business. The undertaker is always the better candidate for elected office, since the nation’s primary business is business. His pronouncements on economic policy are always superior because the undertaker runs closer to the efficiency fairies than the rest of us. Like a good father, he rewards hard work and punishes the lazy.

He can slay the inflation goblins and banish the inefficiencies.

By contrast, the university professor—say, Hyman Minsky—has never met a payroll. Indeed, by nature, the professor’s job is feminine—nurturing, caring. The professor has no real understanding of the market, indeed, is as naïve and shielded from the competitive struggle as is the housewife or child.

All must be subjugated to the Great Decider, the Great Father Undertaker.

The Undertaker can always win every argument by reference to the payrolls he’s met, and also to his own outsized salary. The efficiency fairies know how to pick the winners. The “free” market is always best. Its rewards always trump all others.

But our Father Undertaker is not without some compassion. He will throw out some scraps to the unfit. Give them some welfare that they might take to the market. But do not give them jobs. The Undertaker does not want to hire the unfit. And anything the Public might do is necessarily inefficient. So better to just give the Unfit some cash to spend in the market so that the efficiency fairies can do their magic.

It is more efficient to keep the Unfit idle than to employ them inefficiently. That would piss off the efficiency fairies and let the inflation goblins run wild.

Ultimately, it is all about morality, not economics. The objection to MMT and to the JG is that it offends the conservative’s morality. Let me close with an extended quote from Lakoff as he can explain this more clearly than I can.

“In contemporary America, it is conservative versus progressive morality that governs forms of economic policy…. Most Democrats, consciously or mostly unconsciously, use a moral view deriving from an idealized notion of nurturant parenting, a morality based on caring about their fellow citizens and acting responsibly both for themselves and others with what President Obama has called “an ethic of excellence” – doing one’s best not just for oneself, but for one’s family, community, country and for the world. Government on this view has two moral missions: to protect and empower everyone equally.

The means is The Public, which provides infrastructure, public education and regulations to maximize health, protection and justice, a sustainable environment, systems for information and transportation and so forth. The Public is necessary for The Private, especially private enterprise, which relies on all of the above. The liberal market economy maximizes overall freedom by serving public needs: providing needed products at reasonable prices for reasonable profits, paying workers fairly and treating them well and serving the communities to which they belong. In short, “the people the economy is supposed to serve” are ordinary citizens. This has been the basis of American democracy from the beginning.

Conservatives hold a different moral perspective, based on an idealized notion of a strict father family. In this model, the father is The Decider, who is in charge, knows right from wrong and teaches children morality by punishing them painfully when they do wrong, so that they can become disciplined enough to do right and thrive in the market. If they are not well-off, they are not sufficiently disciplined and so cannot be moral: they deserve their poverty. Applied to conservative politics, this yields a moral hierarchy with the wealthy, morally disciplined citizens deservedly on the top.

Democracy is seen as providing liberty, the freedom to seek one’s self-interest with minimal responsibility for the interests or well-being of others. It is laissez-faire liberty. Responsibility is personal, not social. People should be able to be their own strict fathers, Deciders on their own – the ideal of conservative populists, who are voting their morality not their economic interests. Those who are needy are assumed to be weak and undisciplined and, therefore, morally lacking. The most moral people are the rich. The slogan, “Let the market decide,” sees the market itself as The Decider, the ultimate authority, where there should be no government power over it to regulate, tax, protect workers and to impose fines in tort cases. Those with no money are undisciplined, not moral and so should be punished. The poor can earn redemption only by suffering and, thus, supposedly, getting an incentive to do better.….

Just as the authority of a strict father must always be maintained, so the highest value in this conservative moral system is the preservation, extension and ultimate victory of the conservative moral system itself. Preaching about the deficit is only a means to an end – eliminating funding for The Public and bringing us closer to permanent conservative domination. From this perspective, the Paul Ryan budget makes sense – cut funding for The Public (the antithesis of conservative morality) and reward the rich (who are the best people from a conservative moral perspective). Economic truth is irrelevant here….” (see here)

The opposition to the JG (and the support of welfare like BIG instead of jobs) fits with this conservative morality. The critics do not want a “big, inefficient, public bureaucracy” to create jobs. They want the market test. They do not want a caring, nurturing social system. They want the efficiency fairies and the strict undertakers. Even though some of the critics do understand elements of MMT, they still want the fairytales about the superiority of the Private over the Public. About the benefits of “pulling oneself up by one’s own bootstraps”, about the “self-made macho man” who meets the payroll, about the necessity of punishing the “unfit” to serve as an example to the rest— “There, but for the grace of God, goes John Bradford”.

Lakoff teaches that economic theory cannot trump morality. The arguments against the JG are not economic arguments. They are moral arguments. Pay attention to the framing. The opponents will use words like “efficient”, “productive”, “bureaucracy”, “individual choice”, “freedom”. These are all moral terms reflecting the conservative’s world view. Proponents must change the terms of the debate—“inclusive”, “nurturing”, “caring”, “public”, “community”, “citizens”. Understanding MMT allows us to use the economic system to pursue the many public purposes. There is no private without the public. A well-functioning public is a pre-requisite to a well-functioning private. Let me close with one of my favorite quotes from Keynes (apologies as I’ve probably already used it somewhere in the MMP, but it bears repeating):“The Conservative belief that there is some law of nature which prevents men from being employed, that it is ‘rash’ to employ men, and that it is financially ‘sound’ to maintain a tenth of the population in idleness is crazily improbable–the sort of thing which no man could believe who had not had his head fuddled with nonsense for years and years….” (J. M. Keynes)

Next time: the final installment of the MMP, on the nature of money.

Our free marketeers and their brethren apologists among the orthodox economists pose an imaginary economy that is viewed by some as a utopian version of our own[. . .]

Hence, best to destroy or at least to contain government, and either go back to gold or at least operate the monetary system as if we were on a gold standard (as Greenspan claimed he did as Chairman).

Thanks, Guggzie

A reading of Soddy’s “The Role of Money” shows his clear understanding of the nature of money, and of gold’s corruption of our evolution in monetary science.

Writing in the New York Times on Soddy’s foundational work in the field of ecological economics, author Eric Zencey wrote:

“”Soddy distilled his eccentric vision into five policy prescriptions, each of which was taken at the time as evidence that his theories were unworkable: The first four were to abandon the gold standard, let international exchange rates float, use federal surpluses and deficits as macroeconomic policy tools that could counter cyclical trends, and establish bureaus of economic statistics (including a consumer price index) in order to facilitate this effort. All of these are now conventional practice.

Soddy’s fifth proposal, the only one that remains outside the bounds of conventional wisdom, was to stop banks from creating money (and debt) out of nothing.””

http://www.nytimes.com/2009/04/12/opini ... d=all&_r=0

It’s unfortunate that MMT fails to recognize Soddy’s scientific contribution, and tragic that it maintains the status-quo on this last remaining vestige of un-scientific money.

Thanks.

Frederick Soddy, born in 1877, was an individualist who bowed to few conventions, and who is described by one biographer as a difficult, obstinate man. A 1921 Nobel laureate in chemistry for his work on radioactive decay, he foresaw the energy potential of atomic fission as early as 1909. But his disquiet about that power’s potential wartime use, combined with his revulsion at his discipline’s complicity in the mass deaths of World War I, led him to set aside chemistry for the study of political economy — the world into which scientific progress introduces its gifts. In four books written from 1921 to 1934, Soddy carried on a quixotic campaign for a radical restructuring of global monetary relationships. He was roundly dismissed as a crank.

https://www.nytimes.com/2009/04/12/opin ... d=all&_r=0

use federal surpluses and deficits as macroeconomic policy tools that could counter cyclical trends

Soddy’s fifth proposal, the only one that remains outside the bounds of conventional wisdom, was to stop banks from creating money (and debt) out of nothing.

Banks do this by lending out most of their depositors’ money at interest — making loans that the borrower soon puts in a demand deposit (checking) account

If such a major structural renovation of our economy sounds hopelessly unrealistic, consider that so too did the abolition of the gold standard and the introduction of floating exchange rates back in the 1920s.

If the laws of thermodynamics are sturdy, and if Soddy’s analysis of their relevance to economic life is correct, we’d better expand the realm of what we think is realistic.

his critique of fractional-reserve banking still "remains outside the bounds of conventional wisdom" although a recent paper by the IMF reinvigorated his proposals.

https://en.wikipedia.org/wiki/Frederick_Soddy

The Chicago Plan Revisited

IMF Working Paper No. 12/202

72 Pages Posted: 1 Nov 2012

Jaromír Beneš

International Monetary Fund (IMF)

Michael Kumhof

Bank of England

Date Written: August 2012

Abstract

At the height of the Great Depression a number of leading U.S. economists advanced a proposal for monetary reform that became known as the Chicago Plan. It envisaged the separation of the monetary and credit functions of the banking system, by requiring 100% reserve backing for deposits. Irving Fisher (1936) claimed the following advantages for this plan: (1) Much better control of a major source of business cycle fluctuations, sudden increases and contractions of bank credit and of the supply of bank-created money. (2) Complete elimination of bank runs. (3) Dramatic reduction of the (net) public debt. (4) Dramatic reduction of private debt, as money creation no longer requires simultaneous debt creation. We study these claims by embedding a comprehensive and carefully calibrated model of the banking system in a DSGE model of the U.S. economy. We find support for all four of Fisher's claims. Furthermore, output gains approach 10 percent, and steady state inflation can drop to zero without posing problems for the conduct of monetary policy.

Keywords: Chicago Plan, Chicago School Of Economics, 100% Reserve Banking, Bank Lending, Lending Risk, Private Money Creation, Bank Capital Adequacy, Government Debt, Private Debt, Boom-bust Cycles, Bank Credit, Banking Systems, Economic Models, Monetary Systems

The history of the Chicago Plan is explained in Phillips (1994). It was first formulated in the United

Kingdom by the 1921 Nobel Prize winner in chemistry, Frederick Soddy, in Soddy (1926).

an English radiochemist who explained, with Ernest Rutherford, that radioactivity is due to the transmutation of elements, now known to involve nuclear reactions. He also proved the existence of isotopes of certain radioactive elements.[3][4][5][6][7][8][9][10]

His work and essays popularising the new understanding of radioactivity was the main inspiration for H. G. Wells's The World Set Free (1914), which features atomic bombs dropped from biplanes in a war set many years in the future. Wells's novel is also known as The Last War and imagines a peaceful world emerging from the chaos. In Wealth, Virtual Wealth and Debt Soddy praises Wells’s The World Set Free.

But recommended. I like the part about how a dollar is like an inch, or a kilogram, or a watt or a decibel; a dollar is just a unit of measure, a number. All numbers are imaginary. You can't hold an "inch" or a "gram" or a "seven" in your hand. It's all in your mind. Bwahahahahaha.

But recommended. I like the part about how a dollar is like an inch, or a kilogram, or a watt or a decibel; a dollar is just a unit of measure, a number. All numbers are imaginary. You can't hold an "inch" or a "gram" or a "seven" in your hand. It's all in your mind. Bwahahahahaha.The Nature of Money

Posted on June 27, 2012 by Stephanie Kelton | 76 Comments

By L. Randall Wray

...a discussion of the “nature of money”...

http://neweconomicperspectives.org/2012 ... money.html

at 2:40. Biden explicitly says "Paul Ryan was correct when he did the tax code, what was the first thing we have to go after, SS and Medicare. Now we need to do something about SS and Medicare. It's the only way to find room to pay for it"

https://gritpost.com/joe-biden-paul-ryan-correct/

“I don’t think 500 billionaires are the reason why we’re in trouble… We have not seen this huge concentration of wealth, and the folks at the top aren’t bad guys.” Joe Biden told the audience.

Users browsing this forum: No registered users and 31 guests