Here's the historic exchange rate since 1971 (Click on "All Years")

https://www.macrotrends.net/2550/dollar ... ical-chart

Until recently, it hadn't gone over 150 since 1990.

Martinez

@Macro_Core_View

Disclaimer: I have no knowledge in Economy

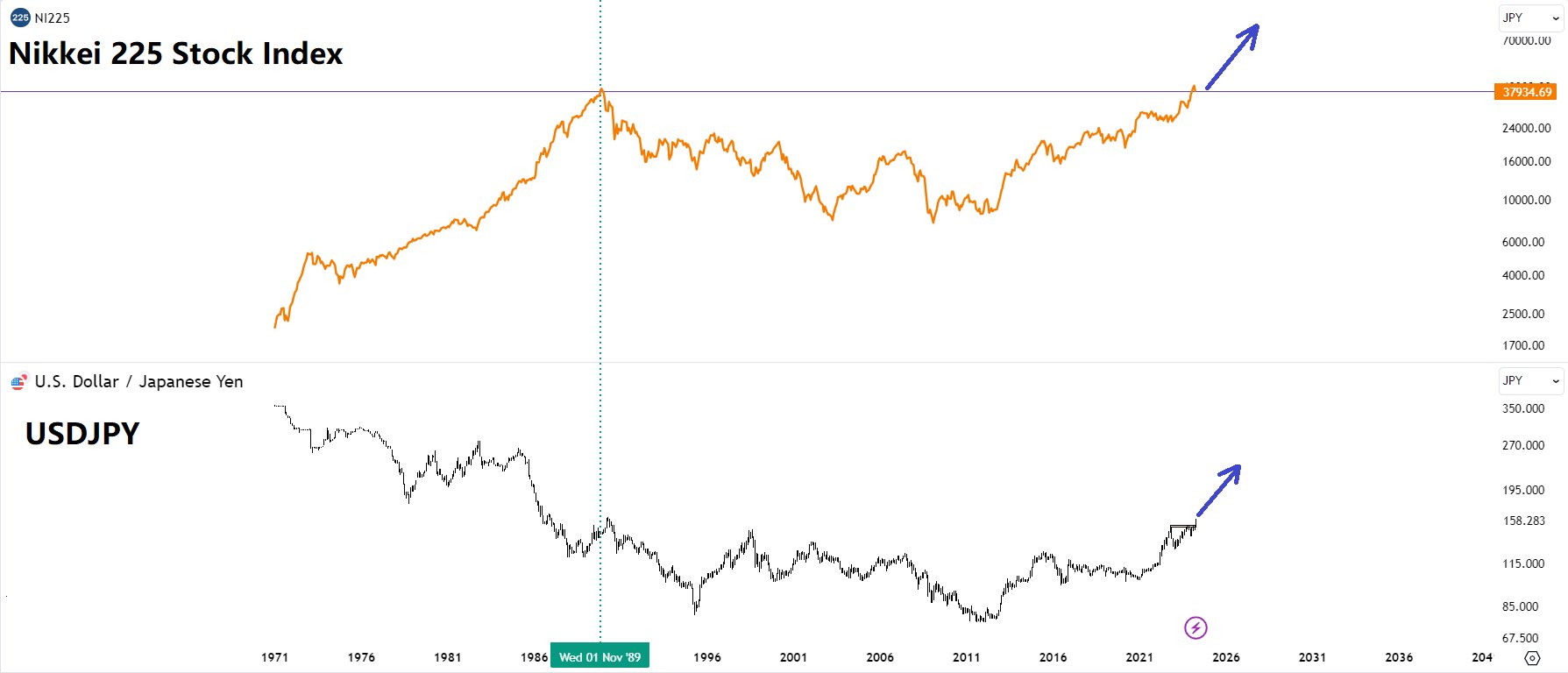

Nikkei 225 vs USDJPY historical chart

Generally USD down, stock market went up. until the Asian stock crashed in 1989 by Soros.

Beyond that lower Japanese yen favours more on Nikkei 225.

i reckon USDJPY = 1:200 is not impossible

Weak yen stokes Japanese concern over strong rise in import prices

April 30, 2024 15:00 JST

TOKYO -- The yen surged to 154 to the U.S. dollar on Monday after falling past the 160 mark, triggering speculation the Japanese government and central bank had intervened in the market to support the nation's currency.

Although authorities have not disclosed whether they stepped in, the government has started expressing concern that the weaker yen has been driving up import costs in the East Asian country.

The limp yen has also been dragging on efforts to push up real wages as Japan looks to eliminate the deflationary mindset that has long overshadowed its economy.

Masato Kanda, Japan's vice finance minister for international affairs, described recent activity in foreign exchange markets as "speculative, rapid and abnormal," but declined to comment when asked about intervention. He said that excessive currency movements negatively impact people's daily lives.

"Higher prices of imported goods are said to be affecting the most vulnerable people and could also drag on Japan's momentum in raising actual wages," the top currency diplomat said. Changes in real wages can be calculated by subtracting consumer price rises from wage increases.

Inflation will accelerate if import prices climb due to the weak yen. Real wage increases were negative for 23 consecutive months through February, with yen weakness further pushing back when real wage increases turn positive.

Wage hikes are currently in full swing, as the government places turning the real wage increase positive through wage hikes as one of its utmost urgent issues.

According to Rengo, the county's largest group of unions, the average base salary that raises corporate fixed labor costs and affects bonuses, retirement pay and pension payouts, would go up at 3.57% through Japan's shunto labor negotiations, 1.46 percentage points higher than the same period the year before.

The wage hike trend is spreading to small and medium-sized companies.

Yet, if the rate of inflation continues to exceed the rate of wage increases, real wages will not turn positive. Japan's consumer price index excluding imputed rent of an owner-occupied house is expected to rise by 3% year-on-year in the three months starting October 2024, according to Meiji Yasuda Research Institute.

If the yen falls to 170, Meiji Yasuda estimates it would push up the CPI by 0.4 points. The research institute sees wages going up less than 3.4%. Thus, the yen's fall to 170 would leave real wage growth negative. The yen at 160 would barely make real wage growth positive either.

A survey of economists released in April by the Japan Center of Economic Research showed that real wages are most likely to turn positive in the three months between July and September.

https://asia.nikkei.com/Economy/Inflati ... ort-prices

Just more of the war on the poor and hollowing out of the middle class...

Yen's surge raises questions over intervention: 3 things to know

Japanese currency rebounds by around 5 to dollar after touching new 34-year low

TOKYO -- The yen's sharp appreciation Monday after crossing the 160 mark against the dollar has triggered speculation that Japanese authorities intervened in the market to shore up their home currency.

The yen has weakened in recent months, fueling concerns over the potential impact on import prices and inflation. But the Japanese currency strengthened to around 155 to the dollar Monday afternoon after reaching a fresh 34-year low earlier that day. It has since been trading around 156.

Here are three things to know about how currency interventions work.

What is a currency intervention?

Japan engages in two main types of interventions: selling dollars for yen to correct excessive yen weakness, or selling yen for dollars to correct excessive yen strength.

The decision to conduct an intervention legally rests with the finance minister, but the vice minister of finance for international affairs often makes the actual call.

The BOJ then carries out the intervention on the finance minister's behalf. In a yen-buying intervention, the bank sells dollars from the Ministry of Finance's Foreign Exchange Fund Special Account to private-sector banks and buys the Japanese currency.

Japan imports a large portion of its food and natural resources. A weak yen makes imports pricier, which can accelerate inflation. Rapid fluctuations in exchange rates can also cause problems for businesses. Yen-buying can help in such cases.

Interventions can also happen outside trading hours or on holidays in Japan, either by the BOJ trading in overseas markets or acting through such overseas intermediaries as the Federal Reserve Bank of New York or the European Central Bank. Requests for such assistance are said to rarely be denied, if ever.

What are some examples of currency interventions by Japan?

Japan intervened a total of three times in September and October of 2022, spending roughly 9.2 trillion yen ($58.7 billion at current rates).

The Finance Ministry tries to time the interventions to maximize their effect. The September intervention happened after then-BOJ Gov. Haruhiko Kuroda held a news conference on the latest monetary policy meeting. The October interventions were carried out early in the morning or late at night, when the market was not being watched as closely.

Japan is believed to have conducted the 2022 interventions unilaterally, tapping only its own foreign reserves.

But currency authorities can also carry out coordinated interventions with overseas counterparts. This lets them pool resources to have a greater impact on the market.

In June 1998, Japan and the U.S. conducted a coordinated yen-buying intervention. The 1985 Plaza Accord was a coordinated effort by the U.S., Japan, the U.K., West Germany and France to curb excessive strengthening by the greenback.

The Group of Seven also bought euros in 2000 and sold yen in 2011.

Are interventions always announced immediately?

Masato Kanda, vice minister of finance for international affairs, told reporters of the September 2022 intervention right after it happened. The announcement led the yen to strengthen by more than 5 against the dollar at one point, to the 140 range.

But he did not immediately announce an intervention that October, declining to comment on the matter at the time.

Such "stealth interventions" make it harder for market watchers to determine why exchange rates are shifting, which can dissuade speculative trades and extend the effects of the intervention.

These interventions are not kept from the public forever. The Finance Ministry releases the total amount of foreign exchange interventions conducted each month at the end of the month. Breakdowns by date are released quarterly.

https://archive.md/MvuuY#selection-3223.0-3239.227

I have become interested in the Plaza Accords recently as being a reason why the Japanese bubble economy collapsed, not simple "overvalued real estate market".

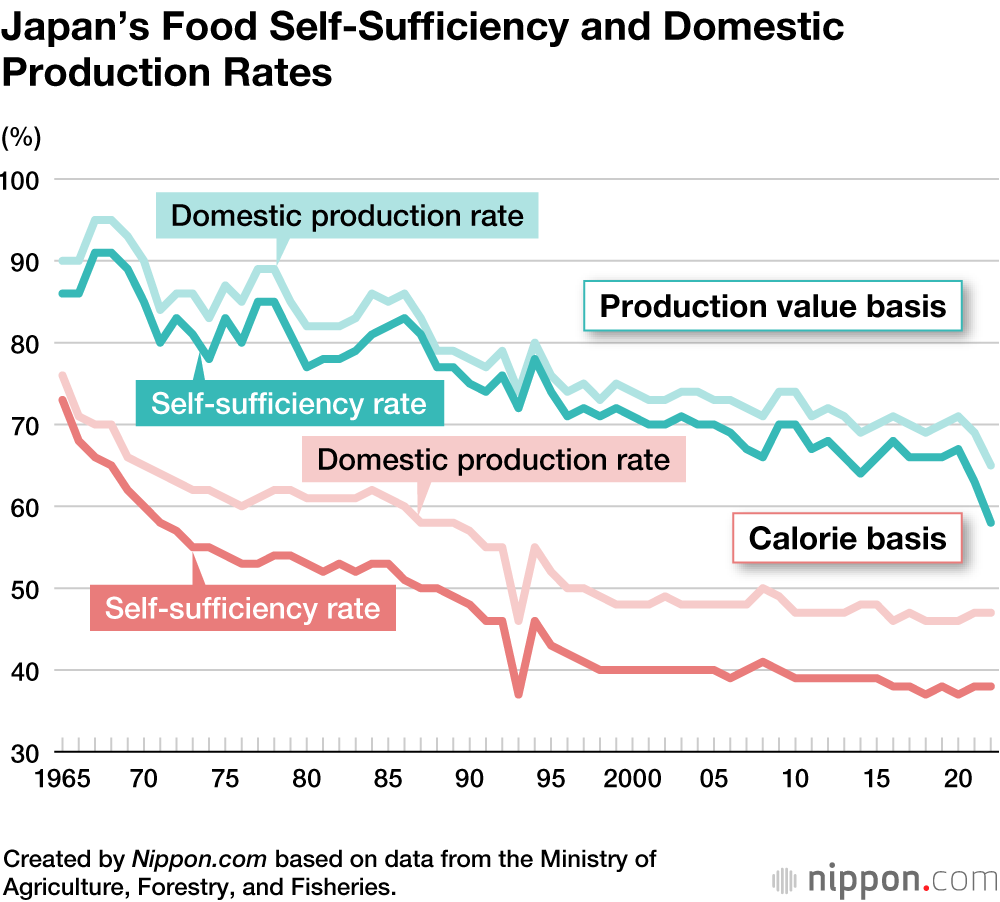

Also, fwiw, while Japan was the wealthiest country for quite a while, it's dependency on food imports has steadily increased to a precarious level:

Surely you have heard about free houses in the Japanese countryside...

The Rural Population of Japan, in millions and ratio to the total population (Reprinted from Japan National Institute of Population and Social Security Research, 2017)

The world does not operate on fixed exchange rates.

The world does not operate on fixed exchange rates.