by drstrangelove » Thu Jan 27, 2022 2:00 am

by drstrangelove » Thu Jan 27, 2022 2:00 am

Looks likes there's a play going on with Reo-to-Rental mortgages. Which in plain terms is rent-backed bond securities.

So after 2008 Freddie Mac & Fannie Mae acquired all the shitty properties from the banks after they had all acquired each other through the TARP bailouts. They held onto all the good stuff and the shit was sold to the govt at a premium.

The govt ended up with all these residential houses no one could afford, but this also extended to commercial real estate as well. The US Treasury created a new position and appointed a Merrill Lynch VP to the role. Control of FMAC&FMAE and thus all their assets was then taken over by the Treasury and overseen by the person in this new position. They then contracted BlackRock to manage liquidation of these assets.

BlackRock then created these new things, I think they are new anyway, called rental-backed securities. The res properties were bundled together and either sold or farmed out to rental corporations who would find tenants. These packages of rental properties were then sold as bonds rated by the underlying value of rent they generated.

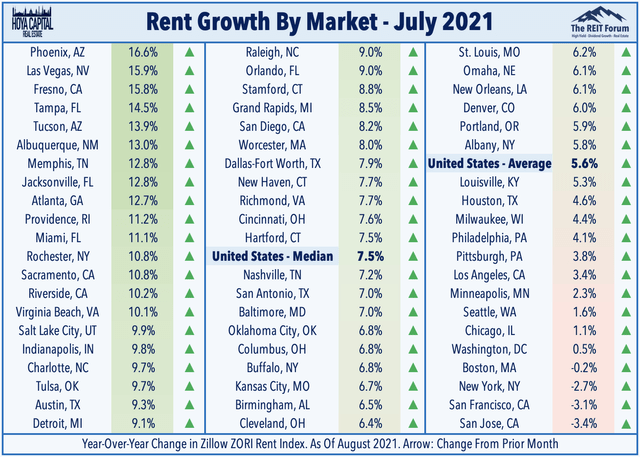

So what were mortgage backed securities were recycled back onto the market as rental-backed securities. This has been happening since 2008. I think these rental-backed securities started to be traded on the stock market as REITs around 2011-2013. Then I think BlackRock and the like created real estate ETFs out of these.

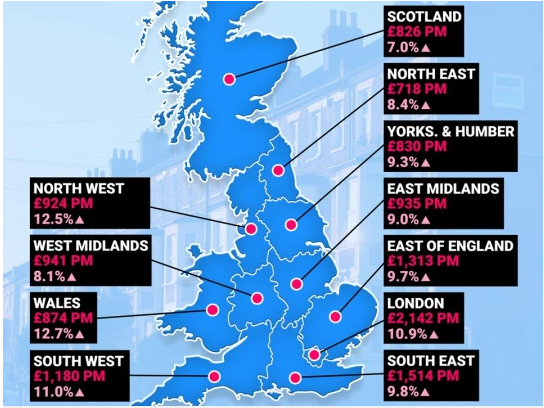

It's interesting to note that since march 2020, all around the world governments have put in place rent moratoriums. Which means for almost two years tenants more or less have had the option not to pay rent. What this would've achieved, along with providing economic relief to those who desperately needed it, was probably two other things:

1) a reduction in the number of small-medium landlords who could no longer rely on quasi-parasidic incomes.

2) a massive reduction in the underlying value of rental backed securities.

I think the whole economic cycle since 1971 has been about property. Real Estate. The creation of a renter-landlord relation between corporations and people. Once this relation has been instituted, and automation replaces operational level roles in the jobs economy, renters will no long be bale to pay rent from generating incomes. If renter income is removed then renter populations become unproductive serfs. Assuming landlords wouldn't just go about liquidating what they see as superfluous life, the only way renters would be able to pay rent is through good behaviour. Which is of course the notion of universal basic income pegged to a social credit score.

If the primary human need is for security. And this is largely provided for through access to food and shelter. Then what's been happening since the1970s with GMO foods and the property market starts to make a whole lot of sense.

What they are doing now with property, is trying to conflate home-ownership with rent. There are a bunch of BlackRock owned(through stock) corporations that now buy properties for prospective 'homeowners', through a rental agreement which allows the renter to purchase the home back from the company after 5 or so years.

In fact everything that is happening right now is the semantical fuckery of ownership. This is what an NFT is. This is what mortgages have become. In fact, it could be argued that for the past couple of decade there hasn't been much of a difference between a mortgage and a lease.

Which leaves the question, what can be done about all this? Nothing at any level other than at the community level. And at the community level the ones which survive WHILE preventing their culture becoming governed by corporate policy are those which have their own sustainable food supplies. Assuming force isn't used, the Amish will be fine, especially the older orders. I wouldn't because I'm an urban child suckling on corporate breast milk. But I'm trying to pick up gardening as a hobby. The ancient neolithic gardening cultures were the ones antithetical to the warlike sun god, perpetual growth heroic warrior tribes that ended up dominating western civilisation. Which is to say, they were the sustainable alternative to growth by using qualitative and intensive adaptions of their productive capacities, as opposed to quantitative and extensive acquisition of more productive capacity through expansionary wars.

This is why these fucks corrupt the seeds. Putting their nanoparticle synthetic jizm inside to impregnate the natural cycles with synthetic growth. I really should grow a garden.