US universities in Africa 'land grab'

Institutions including Harvard and Vanderbilt reportedly use hedge funds to buy land in deals that may force farmers out

John Vidal and Claire Provost

guardian.co.uk, Wednesday 8 June 2011 20.18 BST

US universities are reportedly using endowment funds to make deals that may force thousands from their land in Africa. Photograph: Boston Globe via Getty Images

Harvard and other major American universities are working through British hedge funds and European financial speculators to buy or lease vast areas of African farmland in deals, some of which may force many thousands of people off their land, according to a new study.

Researchers say foreign investors are profiting from "land grabs" that often fail to deliver the promised benefits of jobs and economic development, and can lead to environmental and social problems in the poorest countries in the world.

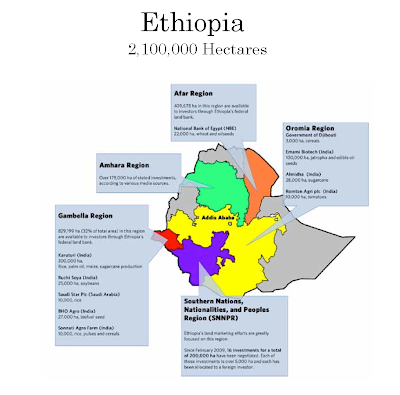

The new report on land acquisitions in seven African countries suggests that Harvard, Vanderbilt and many other US colleges with large endowment funds have invested heavily in African land in the past few years. Much of the money is said to be channelled through London-based Emergent asset management, which runs one of Africa's largest land acquisition funds, run by former JP Morgan and Goldman Sachs currency dealers.

Researchers at the California-based Oakland Institute think that Emergent's clients in the US may have invested up to $500m in some of the most fertile land in the expectation of making 25% returns.

Emergent said the deals were handled responsibly. "Yes, university endowment funds and pension funds are long-term investors," a spokesman said. "We are investing in African agriculture and setting up businesses and employing people. We are doing it in a responsible way … The amounts are large. They can be hundreds of millions of dollars. This is not landgrabbing. We want to make the land more valuable. Being big makes an impact, economies of scale can be more productive."

Chinese and Middle Eastern firms have previously been identified as "grabbing" large tracts of land in developing countries to grow cheap food for home populations, but western funds are behind many of the biggest deals, says the Oakland institute, an advocacy research group.

The company that manages Harvard's investment funds declined to comment. "It is Harvard management company policy not to discuss investments or investment strategy and therefore I cannot confirm the report," said a spokesman. Vanderbilt also declined to comment.

Oakland said investors overstated the benefits of the deals for the communities involved. "Companies have been able to create complex layers of companies and subsidiaries to avert the gaze of weak regulatory authorities. Analysis of the contracts reveal that many of the deals will provide few jobs and will force many thousands of people off the land," said Anuradha Mittal, Oakland's director.

In Tanzania, the memorandum of understanding between the local government and US-based farm development corporation AgriSol Energy, which is working with Iowa University, stipulates that the two main locations – Katumba and Mishamo – for their project are refugee settlements holding as many as 162,000 people that will have to be closed before the $700m project can start. The refugees have been farming this land for 40 years.

In Ethiopia, a process of "villagisation" by the government is moving tens of thousands of people from traditional lands into new centres while big land deals are being struck with international companies.

The largest land deal in South Sudan, where as much as 9% of the land is said by Norwegian analysts to have been bought in the last few years, was negotiated between a Texas-based firm, Nile Trading and Development and a local co-operative run by absent chiefs. The 49-year lease of 400,000 hectares of central Equatoria for around $25,000 (£15,000) allows the company to exploit all natural resources including oil and timber. The company, headed by former US Ambassador Howard Eugene Douglas, says it intends to apply for UN-backed carbon credits that could provide it with millions of pounds a year in revenues.

In Mozambique, where up to 7m hectares of land is potentially available for investors, western hedge funds are said in the report to be working with South Africans businesses to buy vast tracts of forest and farmland for investors in Europe and the US. The contracts show the government will waive taxes for up to 25 years, but few jobs will be created.

"No one should believe that these investors are there to feed starving Africans, create jobs or improve food security," said Obang Metho of Solidarity Movement for New Ethiopia. "These agreements – many of which could be in place for 99 years – do not mean progress for local people and will not lead to food in their stomachs. These deals lead only to dollars in the pockets of corrupt leaders and foreign investors."

"The scale of the land deals being struck is shocking", said Mittal. "The conversion of African small farms and forests into a natural-asset-based, high-return investment strategy can drive up food prices and increase the risks of climate change.

Research by the World Bank and others suggests that nearly 60m hectares – an area the size of France – has been bought or leased by foreign companies in Africa in the past three years.

"Most of these deals are characterised by a lack of transparency, despite the profound implications posed by the consolidation of control over global food markets and agricultural resources by financial firms," says the report.

"We have seen cases of speculators taking over agricultural land while small farmers, viewed as squatters, are forcibly removed with no compensation," said Frederic Mousseau, policy director at Oakland, said: "This is creating insecurity in the global food system that could be a much bigger threat to global security than terrorism. More than one billion people around the world are living with hunger. The majority of the world's poor still depend on small farms for their livelihoods, and speculators are taking these away while promising progress that never happens."

http://www.guardian.co.uk/world/2011/ju ... -land-grab

*

sick...